- Analytics

- Fundamental Analysis

- Budget 2021, COVID made it much important

Budget 2021, COVID made it much important!

Sunak was the happiest!

As usual in the UK, yearly budget, each year provided by the Chancellor of the Exchequer - the government's chief finance minister - to MPs in the House of Commons. The budget's most focuses are on the Tax, Government spending money, and forecasts for how the UK economy could perform in the future. However, this year, it followed more closely as the pandemic caused the Worst UK economic slump for 300 years.

Why is it much important now?

First of all, it is the first budget since the pandemic was officially declared. On the other hand, UK yields rising to 0.780% from 0.176% of a year ago -in line with Bonds, Bunds and...- highlighting concerns that unprecedented government spending to support the global economy via COVID-19 could move inflation up numbers, in a massive selloff in Securities, especially since the beginning of 2021.

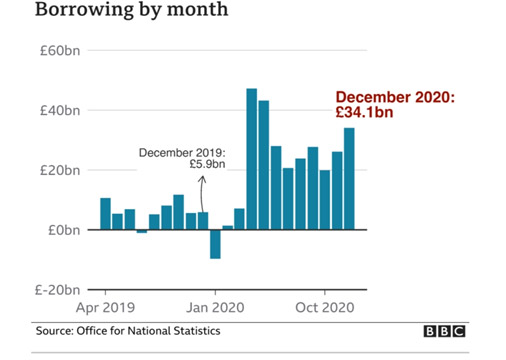

"Government borrowing for this financial year has reached £271bn. That's £222bn more than a year ago. This has pushed up the national debt to £2.13 trillion. That's more than 99% of GDP - the value of goods and services produced by the UK. That has not happened since the early 1960s." (BBC News)

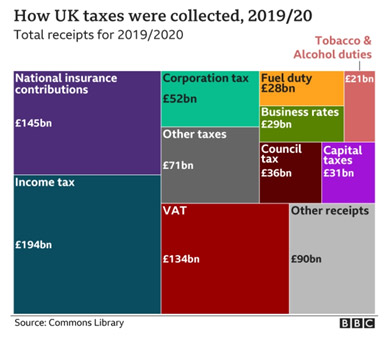

Increasing the government debt will bring up the first question: how will they pay them back? The most income of government is from Taxes. Taxes always were important; however, since we are in such a mass situation, it will be more important, and we have to look at it more closely.

Before going to more detail and see what yesterday Mr. Sunak passed to MPs in the House of Commons, I need to mention inflation concerns and global experience.

Back in 2008-9, and after the financial crisis, the International Monetary Fund recommended just 2% of GDP to offset the global contraction. Yet, many countries and economists were worried about its effect on inflation. However, after years we understood that since we are always creating new wreaths, these overprinted bills usually go to new wealth areas and stock markets. And that was the reason why the $787 billion US bill in 2008-9 came over 4T in 2020-21, and here in the UK, £271bn by now.

And what Sunak told yesterday?

I want to go through tax policy first, before any other topic, because as long as we do not know what we have, playing on spending has no mean.

Frozen capital gains tax exemptions at the current level until 2025-26, and for more than 1.5 million smaller companies with profits of less than £50,000, rates will stay at current 19% for about 1.5 million smaller companies with profits of less than £50,000, but for companies with profits above £250,000, will be rise to 25% in April 2023. And no changes for income tax, national insurance, or VAT. The most important headlines of taxation were these. "And the freeze on income tax thresholds is expected to bring 1.3 million more people into paying income tax - and a million more into paying at the higher rate." (BBC) Sounds fair.

His Coronavirus support plan is where I have a bit of fear of results in the longer time. Firstly Government will continue paying 80% of employees' wages for hours they cannot work until September and £20 weekly uplift in Universal Credit worth £1,000 a year to be extended for another six months, more support for Vaccination progress, £5bn to help High Street firms reopen, 95% mortgages backed to return to aid first-time buyers by Government, and £408m for museums, theatres and galleries in England to help them reopen when Covid restrictions ease. With all respect, there are two questions. Firstly, this over lamb help would not effect on many employees to sleep on government help and not to try to get back the Job earlier, an second, even though in this plan, self-employed supports also extended until September, which probably going to cover 600,000 more people, still is not clear in the declaration of self-employed and how they can be eligible for help.

And finally, Government Outlook

After 10% shrank in 2020, the UK government expects 4% economic growth this year, but it can be in pre-Covid levels not before the middle of 2022, with 7.3% next year. About employment, the government is more optimistic. Unemployment is expected to peak at 6.5% next year, much lower than the previous prediction of 11.9%. But the dark point is 2021-22 government borrowing is about £234bn.

At the end and before checking the market reaction, need to mention a comment from IFS director, Mr. Paul Johnson: "Mr. Sunak made much of his desire, to be honest, and to level with the British people."

Market Reaction

Before and after the meeting, both Pound and UK100 had the same reactions. Decreasing right before the meeting, correction after meeting, deeper fall overnight trading, and recovering in today's EU season. The main reason was the uncertain decision of big players and market adjustment after the meeting, especially because the UK market was not active after the meeting, so the market was waiting for the rational approach. Technically in the H1 chart, Cable and UK100 traded around their PP, respectively, sitting on 1.3960 and 6620, while momentum indicators still supporting uptrend for UK100 and negative configuration on intraday trading. For both, S1 at 1.3910 and 6570 play a key role to support upper prices, while breaching under these levels will change the technical configurations for a downtrend.