- Analytics

- Market Overview

ECB may lower the rate tomorrow - 11.3.2020

Upward correction in the US stock market

On Tuesday, US stocks quotes rose significantly after the record (since 2008) one-day fall on this Monday. US President Donald Trump said he would appeal to the Congress with a proposal to lower taxes in order to stimulate the US economy, which suffered recently from the outbreak of coronavirus. Market participants also expect the Fed’s second rate cut this year at a meeting on March 18. The S&P 500 (+4,94%), Nasdaq (+4,95%) and Dow Jones Industrial Average (+4,89%) indices fell. The financial (+ 6%) and energy (+ 5%) sectors of the S&P 500 index became the growth leaders yesterday. Shares of United Parcel Service (+ 6.5%) and Amazon.com (5.1%) rose due to high recommendations by brokerage companies. Yesterday, the turnover of US exchanges amounted to 15.8 billion shares, which is 37.5% more than the 20-day average. Today data on inflation will come out in the US. Their preliminary forecasts are positive. The ICE exchange index rose yesterday amid a statement made by US President Donald Trump on measures to stimulate the economy.

European stock indices rise today amid the Bank of England rate cut

European stocks stocks rose yesterday along with American stocks. Today, Bank of England cut the rate from 0.75% to 0.5% to stimulate the British economy and reduce the damage from the COVID-19 epidemic. Investors perceived this news very positively, as the likelihood of a decline in the ECB rate at tomorrow's meeting on March 12 increases. The Bank of England joined the regulators of the United States, China, Canada and Australia, which lowered their rates earlier. The British FTSE 100 index rose 1.7% in the morning. Important economic data for January will be published today in Britain: monthly trade balance and GDP, industrial production and so on. EUR/USD quotes are being corrected down while chances of reducing the ECB rate rise.

Nikkei jumped up at almost 1% yesterday together with other indices

Asian indices fell today. Nikkei again approached a 15-month minimum. Investors are concerned about the reliability and condition of the assets of the Bank of Japan, which has implemented a super-soft monetary policy and bought up shares at the level of 19,500 points Nikkei.Note that a controlling stake in the Bank of Japan belongs to the Japanese Government, but they are listed on the Tokyo Stock Exchange. Today, these securities fell by 3.5% and updated the historical minimum. The Chinese Shanghai Composite Index today fell by 0.9%, while the Hong Kong’s Hang SengIndex fell by 0.6%. Investors doubt that government measures will be sufficient to support the economy. The yen fell today against the US currency to a psychological level of 105 yen per dollar.

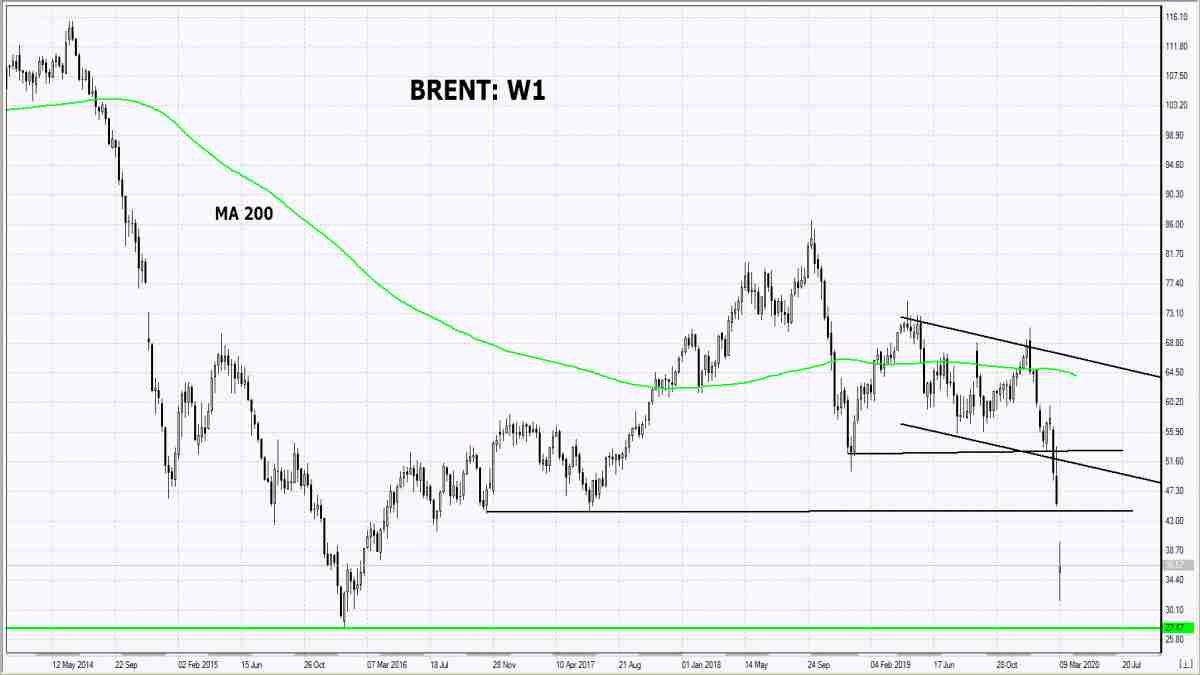

Brent tried to adjust up, but so far unsuccessfully

Quotes of Brent futures rolled down, failing to break through the resistance level of $ 40 per barrel. Saudi company Saudi Aramco announced an increase in production by 1 million barrels per day (bpd). In recent months, Saudi Arabia has mined 9.7 million bpd, but a lot of oil has appeared to be accumulated in storage. Currently, Saudi Arabia implements 12 million bpd and intends to increase sales to 13 million bpd in order to unload oil storage facilities. From their January peaks, Brent and WTI collapsed by about 2 times. This was facilitated by Russia's decision to abandon restrictions on oil production and withdraw from the OPEC + agreement. The drop in oil quotes happened due to a decline in global business activity and a decrease in demand due to the epidemic of coronavirus and quarantine in a range of countries. Some Western agencies expect Brent to collapse on this negative situation to the lows of early 2016 - within $ 30 per barrel.

See Also