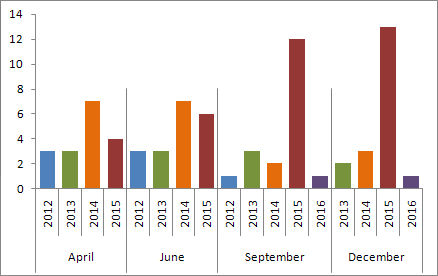

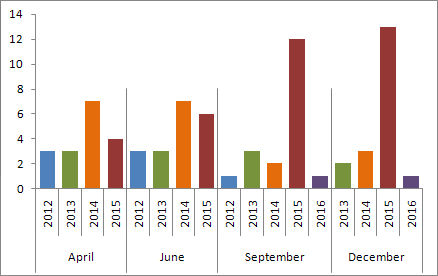

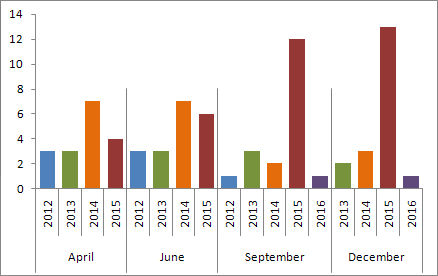

The Open Market Committee of Federal Reserve went yesterday for unprecedented measures, deciding to keep the federal funds rate near zero level unless the unemployment rate drops to 6.5%, and inflation exceeds 2.5%. The Fed Chairman, Ben Bernanke said at the press-conference after the CB meeting, that the binding of monetary policy to economic results is clearer and more predictable for the public than the binding to the terms. Earlier, the CB stated that it will keep rates low until the middle of 2015. However, Bernanke said that the unemployment rate is not the only thing the Fed will be focused on, while making a decision. There is a diagram below showing the expectations of the Committee members on the start dates for monetary policy tightening in the last four meetings. As we can see, the majority of the members have been retarget at 2015.

Expectations of start dates for the monetary policy tightening, number of votes

Another important decision was launching a new round of quantitative easing. The program volume would be $ 45 billion per month that will be spent for the long-term government bonds purchase over the mortgage-backed securities purchase program with volume of 40 billion dollars a month, already launched in September. However, Bernanke said that monetary policy has its own limits, and that despite the new incentives, the broadly speaking fiscal problems and the "fiscal cliff" may cause a new wave of recession. Current Central Bank forecasts, the economy is expected to grow by 2.3%-3.0% next year, while in September this range was 2.5%-3.0%.