- 분석

- 기술적 분석

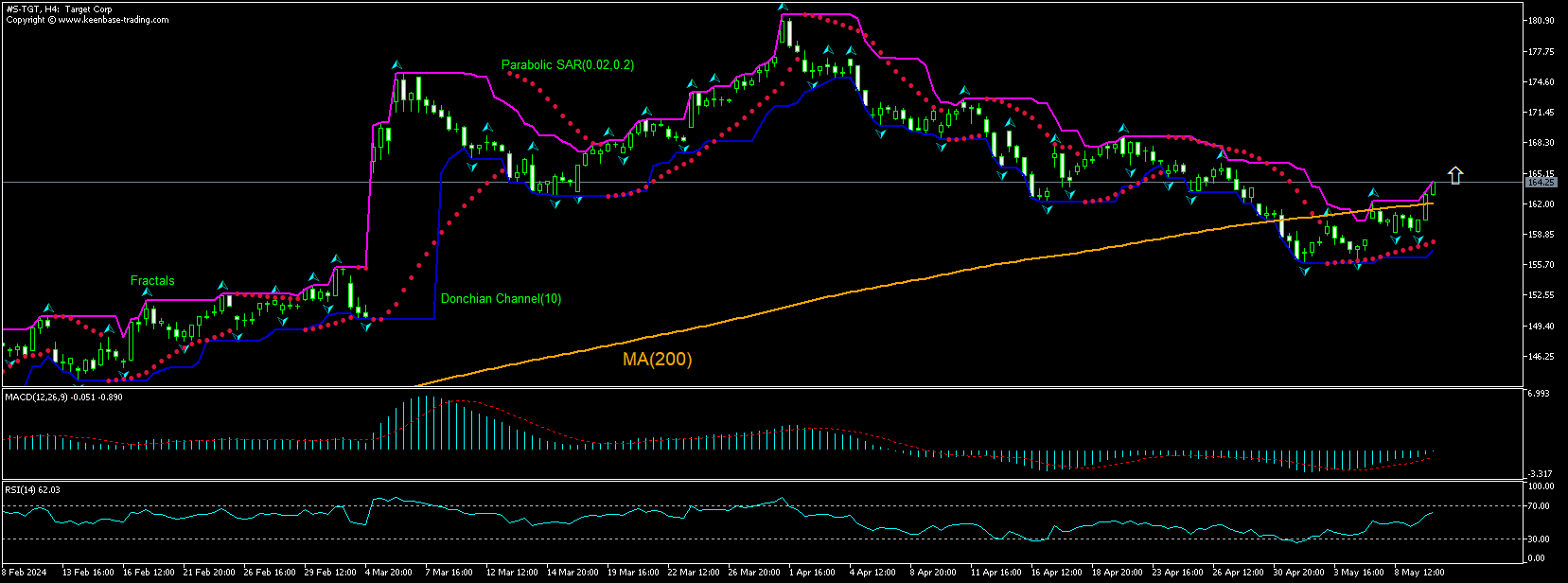

Target Corp. 기술적 분석 - Target Corp. 거래: 2024-05-10

Target Corp. 기술적 분석 요약

위에 164.30

Buy Stop

아래에 158.10

Stop Loss

| 인디케이터 | 신호 |

| RSI | 중립적 |

| MACD | 구매 |

| Donchian Channel | 구매 |

| MA(200) | 구매 |

| Fractals | 중립적 |

| Parabolic SAR | 구매 |

Target Corp. 차트 분석

Target Corp. 기술적 분석

The technical analysis of the Target stock price chart on 4-hour timeframe shows #S-TGT,H4 has breached above the 200-period moving average MA(200) after rebound following a retreat to two-month low a week ago. We believe the bullish momentum will continue after the price breaches above the upper Donchian bound at 164.30. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower Donchian bound at 158.10. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (158.10) without reaching the order (164.30), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

지수 - Target Corp. 기본 분석

Target is paying dividend on 10th of June. Will the Target stock price continue recovering?

Target Corporation operates as a general merchandise retailer in the United States. Its market capitalization is $76.0 billion. The stock is trading at P/E ratio (Trailing Twelve Months) of 17.85 currently, company’s revenue (ttm) was $107.4 billion, while the Return on Equity (ttm) was 33.56% and the Return on Assets (ttm) at 6.79%. Target will be reporting quarterly results on May 22. The company's upcoming dividend is $1.10 a share and investors who consider the stock purchase for the dividend will have to take action before the 14th of May to receive the dividend. Company’s financials show Target doesn’t pay more dividends than it earned in profit: Target paid out 49% of its profit last year, its dividend policy isn’t unsustainable. At the same time dividends amounted to 53% of the company's free cash flow last year, which is within a normal range for most dividend-paying companies. So Target's dividend is sustainable as it is covered by both profits and cash flow. And in the last 10 years Target has lifted its dividend by approximately 9.8% a year on average. Rising dividend is bullish for a company stock price.

Note:

해당 개요는 유익하고 튜토리얼적인 성격을 가지고 있으며 무료로 게시됩니다. 이 개요에 포함된 모든 데이터는 어느 정도 신뢰할 수 있는 것으로 간주되는 오픈 소스에서 받은 것입니다. 또한 표시된 정보가 완전하고 정확하다는 보장이 없습니다. 개요가 업데이트되지 않습니다. 의견, 인디케이터, 차트 및 기타 항목을 포함하여 각 개요의 전체 정보는 이해의 목적으로만 제공되며 재정적 조언이나 권장 사항이 아닙니다. 전체 텍스트와 그 일부, 차트는 자산과의 거래 제안으로 간주될 수 없습니다. IFC Markets와 그 직원은 어떤 상황에서도 개요를 읽는 동안 또는 읽은 후에 다른 사람이 취한 행동에 대해 책임을 지지 않습니다.