- Analytics

- Market Data

- Precious Metals Prices

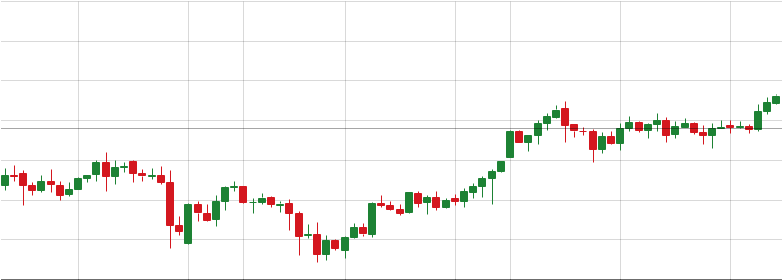

- Gold Historical Chart

Gold Spot Price Today - XAUUSD Live Chart

As of Mar 4 the Gold spot price per ounce is $5144.270. This page includes full information about the Gold, including the XAUUSD live chart and dynamics on the chart by choosing any of 8 available time frames.

XAUUSD Price Live

Gold today is an important piece of information for traders for several reasons.

The XAUUSD price is a key indicator of a precious metals's supply and demand. By knowing the current price, traders can assess potential future price movements and make informed decisions about buying, selling, or holding their positions.

Tracking the Gold price over time allows traders to identify trends in the market. Is the price rising or falling? Understanding these trends can help traders predict future price movements and capitalize on profitable opportunities.

Precious metals market is volatile, and prices can fluctuate significantly. Knowing the current price helps traders manage their risk by setting stop-loss orders and other risk management strategies.

XAUUSD Price and Rate Today

Staying on top of the XAUUSD price is crucial for traders in today's market. The Gold price serves as a benchmark for many precious metals contracts, and knowing its current value allows traders to make informed decisions in two key ways:

- Measuring Market Value: by knowing the current XAUUSD price, traders can assess the overall health of the market. A rising Gold price might indicate strong demand, while a falling price could suggest a surplus in supply. This understanding of market value helps traders make informed decisions about buying, selling, or holding their positions.

- Benchmarking Performance: many precious metal contracts are priced relative to the XAUUSD price. Having this information readily available allows traders to benchmark the performance of their investments and compare them to the overall market. This comparison helps traders identify opportunities and adjust their strategies accordingly.

Gold Historical Chart

- 1 MIN

- 5m

- 15m

- 30m

- 1h

- 4h

- 1d

- 1w

Technical Analysis

Technical analysis is a method of studying and evaluating market dynamics based on the price history. Its main purpose is to forecast price dynamics of a financial instrument in future through technical analysis tools. Technical analysts use this method of market analysis to forecast the prices of different currencies and currency pairs. This type of the analysis will allow you to make market forecast based on studying historical prices of the trading instruments.

See also latest technical analysis of the price dynamics of Gold Dollar: XAUUSD forecast.

XAUUSD News

Will Gold Keep Rising

Since 2020 gold price climbed more than 230% at the same time central banks started one of the biggest buying waves in decades....

Gold and Oil Analysis in 2025

In 2025 gold, and aluminum have outperformed other commodities. Oil is still volatile, and gas is limited by supply issues....

Will Gold Stay Above $3,300? Key Levels to Watch

Gold prices rebounded in Asian trade on Wednesday after falling sharply earlier in the week. The brief selloff followed news...

Should You Buy Gold Now? Analysis of Price Trend, War Impact, Fed Policy

Gold is hovering near $3,420 per ounce, just below its all-time high set in April. Multiple fundamental forces are driving...

Gold Hits Record Highs: Why is Gold Price Rising?

Gold prices have reached record highs, climbing to $3,380 an ounce. That’s a 25% gain just this year — and a huge 40%...

Gold Price News Analysis: Will gold price go down?

Gold hit a record high of $3,016.92 per ounce, surpassing the key $3,000 level for the second time in a week. Many headlines...