- Innovations

- Articles on application of PCI

- New Trading Horizons

The Exchange Rate and the Creation of New Financial Instruments on its Base

What is an exchange rate?

Exchange or currency rate is the unit of one national currency expressed in the units of another national currency.

Meanwhile, the value of a certain currency is formed based on the supply and demand for it in the international currency market (Forex). The correlation of the values of two currencies is called a currency pair, which is the main instrument for trading in the Forex market.

Each currency has its own 3-letter ISO code. For example, the currency pair of the British pound and the US dollar is expressed as GBP/USD. The currency which stands the first in the pair is called the base currency, while the second one is the quoted one. All the currencies in the Forex market are products and trading operations are performed with a base currency i.e. buying the GBP/USD, a trader buys the British pound with the US dollars- in this case the value of the base currency is measured in dollars.

For example, if the exchange rate of the GBPUSD is 1.2599, it means that the value of 1 GBP equals to 1.2599 USD and the exchange rate of the USD/GBP in this case would be 0.7937 (1/1.2599). In the first case the quote is called reversed, while in the second case- direct.

There are also cross rates, where the exchange rate of two currencies is set through the exchange rate of each of them against a third currency, usually against the US dollar.

IFC Markets gives an opportunity to easily convert any currency with the help of online calculator..

New stage of the exchange rate development: PCI

Up to now the concept of the “exchange rate” has been referred to national currencies only. Meanwhile, commodities, stocks, stock indices are quoted only in currencies. For example, by trading in the commodity market, a trader has to perform two transactions in order to exchange wheat futures for corn futures - sell wheat for the US dollars and buy corn for the same dollars. But it would have been much easier and more effective to just exchange those futures.

IFC Markets developed the unique Portfolio Quoting Method for creating personal synthetic instruments (PCI), due to which investors got the opportunity to create instruments and make operations (buy/sell) with them through direct exchange - some stocks for others, commodities for commodities, indices for indices. The general principle of creating a synthetic instrument is similar to the principle of creating cross rates - the PCI exchange rate is set through the value of the base and quoted asset in the US dollars.

These custom instruments allow to make full technical analysis of the dynamics of the relations between two assets in time, as well as to visualize the correlations between various assets (for example, Oil against Gold, Apple stocks against the Euro).

Stock exchange rate

Stock exchange rate is the unit of the stock of one company expressed in the units of the stock of another company.

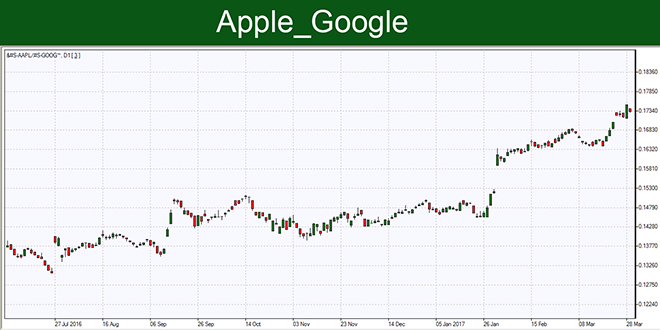

For example, the exchange rate of the AAPL/GOOG synthetic instrument, with the cost of $140 of one Apple stock and $813 of one Google stock, will amount to 0.1722 (140/813).

Any personal instrument, and correspondingly exchange rates of stocks available for trading may be easily created on NetTradeX terminal by selecting in the “Market watch” window the “Create PCI” option and by indicating the assets which should enter the list of the base and the quoted part of your PCI.

By saving the PCI created by you in the list of the used instruments you may easily drag the price history chart to your screen later on and trade it.

Commodity exchange rate

Commodity exchange rate is the value of one commodity expressed in the value of another commodity.

For example, the exchange rate of the PCI WHEAT/CORN, with the cost of $426 of one wheat contract and $360 of one corn contract, will amount to 1.1833.

The personal instruments from the commodities available for trading are created the same way as PCIs from stocks (described above).

Trading portfolios from various assets

Besides trading simple PCIs from single instruments, a trader may create and trade portfolios from several instruments. In case of portfolio trading, the base and quoted parts of a synthetic instrument consist of portfolios (stocks of hi-tech companies, precious metals, currencies, etc.).

Note, that portfolios may be of various complexities and include from two to 25 financial assets (commodities, currencies, stocks, indices). While making a portfolio each asset is given an individual weight, measured in the US dollars.

For example, having created the portfolio from the stocks of hi-tech Apple, Google, Facebook companies against the stocks of Exxon Mobil and Chevron oil companies (AAPPL_GOOG_FB/XOM_CVX), a trader may make a comparative analysis of the two most important industries of the US economy and reveal trends on the basis of which he will develop his trading strategy.

Such analysis can be carried out on PCI too, comprised of stocks of any energy company, as the base asset of the PCI pairs with Brent oil, which is the quoted asset. A more complex personal composite instrument may be created, which will include the combination of stocks of major energy companies in the base part and Brent oil in the quoted part, and its analysis is made in the similar way.

Having created a portfolio personal instrument, a trader may trade it as any other financial instrument during the trading hours of all the included components.

Library of personal instruments

Despite the fact that constructing unique instruments provides endless opportunities to traders, before starting to create them it is necessary to learn analyzing the charts and understand the difficult interrelation of assets and their combinations. For this you may use the Synthetic Instruments library created by the analysts of IFC Markets.

Our professionals created several groups of synthetic instruments where you can choose the more suitable one for your trading strategies:

For example:

- Technology_Stocks. The portfolio is made up of the stocks of 10 largest hi-tech companies of the world, traded in NASDAQ and NYSE Stock Exchanges. The portfolio is quoted in the US dollars. This PCI may be used for trading and analysis of the hi-tech market dynamics, as well as its comparative analysis with other industrial indices;

- Indices_EU. The PCI reflects the price dynamics of the portfolio from 3 most important stock indices of Europe: DE 30 (DAX analog), FR 40 (CAC40 analog) and GB 100 (FTSE100 analog). The portfolio is quoted in euro. The PCI is suitable for traders who specialize in the European stocks.

Every user of NetTradeX terminal gets access to the unique Portfolio Quoting Method.

To trade PCI instruments offered exclusively by IFC Markets, you need to open a free account and download the NetTradeX platform.

Previous articles

- Profiting in bear and bull oil markets

- Currency indices: unveiling central banks’ secrets

- Pair Trading with Inverse Spread: 3 Steps

- Portfolio Trading Method – Expanding the Range of Trading Instruments

- Portfolio Quoting Method – New Ways for Analysis of Financial Markets

- Portfolio Quoting Method - New Trading Strategies