- Education

- Forex Trading Strategies

- Trading Styles Strategies

- Forex Day Trading Strategies

- Momentum Trading Strategy

Momentum Trading Strategy - What is Momentum Trading

The idea of momentum investing is simple - buy low, sell high. It looks like a straightforward reaction to a market change. But it can’t be that easy. Let’s dive in and learn how it can be used and when, what are the best momentum indicators, to form an idea, when it is best used.

KEY TAKEAWAYS

- Momentum investing is a trading strategy in which investors buy stocks that are rallying and sell them when they have peaked and are about to drop.

- Momentum in trading is often influenced by timeframe.

- Momentum indicators are technical analysis tools that help to identify the strength or the weakness of the stock’s price.

Momentum Trading Strategy

Momentum strategy wasn’t that popular until Richard Driehaus showed the ropes: he used it to run his funds and succeeded. The idea was that with "buying high and selling higher" strategy more money could be made. He believed that selling loser stocks and buying winners is a working approach. Later on techniques he used summed up in a Momentum Trading strategy.

Momentum Trading Strategy is set to exploit market volatility; taking short -term positions on stocks that are going up and waiting until they start showing signs of falling and selling them. And along the chain goes, finding winners and buying them and selling the losers.

The momentum investor seeks to take advantage of the herd instinct of investors by leading the group and being the first to take the money and run away.

The process goes like this:

- Selecting equities

- Risks concerning the timing in opening and closing the trades

- Entry timing - getting into the trade early

- Position management with wide spreads and holding period

- Exit points require consistent charting

Worth mentioning, that momentum investing works, but not for everyone. Based on the practice of momentum investing, it can most likely lead to overall portfolio losses. When a trader buys rising stocks or sells falling stocks, it can lead to a reaction to older news than investment fund professionals.

Momentum Day Trading Strategies

Day trading requires the market to move, to be able to make money on fluctuations. Momentum trading fits into day trading perfectly from that perspective. Plus side is, there always will be a volatile market to take advantage of.

So how to find the right stock and make a move - buy low, sell high?

First of all, traders need to find a stock that is moving. Stocks that don't move aren't of interest. For that traders need to set up some kind of stocks scanning system (for example reversal trading strategies scanners).

Second, momentum stocks all have a few things in common

- Strong daily charts - above the MA and with no nearby resistance.

- High relative volume is at least 2 times higher than average - the current volume for today is compared with the average volume for that time of day.

- Fundamental reasons such as PR, profits, FDA announcement, investor activists, or other big news.

Momentum in trading is often influenced by timeframe. Though some momentum traders prefer to take positions in the long-term, one of the most appropriate strategies for trading on momentum is the short-term approach of day trading.

The aim of day trading is to enter and exit multiple positions quickly throughout the day, with the aim of making a profit from small price movements. Therefore, momentum traders look for markets and securities with a high volume, so that they can buy and sell stocks quickly without interruption.

When a range is at least $5, it is considered profitable for momentum intraday trading. Smaller price movements are better for scalping strategies, which are very common within the forex market.

What is Momentum Trading

Momentum trading is a technique where traders buy and sell financial assets after being impacted by recent price trends. Traders tend to take advantage of uptrends or downtrends in financial markets until the trend begins to fade away.

Momentum trading strategies focus on price movements, a form of technical analysis that is very popular with short-term traders. Traders calculate momentum price forecasts based on historical price trends and data, and given the volatility of financial markets, prices can move and the market can move in unexpected directions at any time.

Let's not forget that markets are also influenced by press releases and other macroeconomic events that need to be considered when building an impulse trading strategy and risk management plan.

Best Momentum Indicators

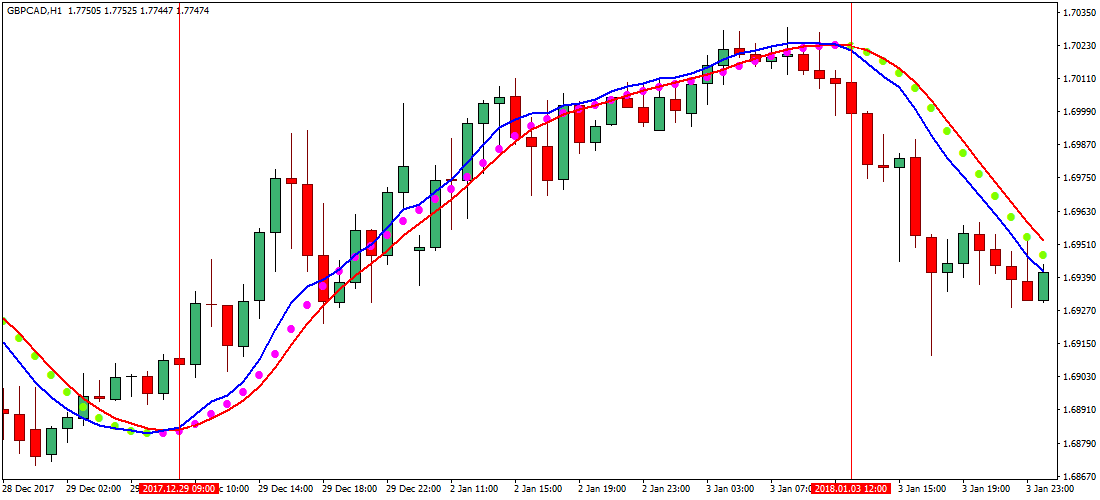

Momentum indicators are technical analysis tools that help to identify the strength or the weakness of the stock’s price. Most common momentum indicators include RSI, MACD and ADX.

- MACD - one of the most popular indicators; indicates momentum as it oscillates between moving averages as they converge, overlap, and move away from one another. An important aspect of the MACD is the histogram, which reveals the difference between the MACD line and the 9-day EMA. When the histogram is positive – over the zero-midpoint line but begins to fall towards the midline, which means weakening uptrend. On the other side, when the histogram is negative, under the zero-midpoint line but begins to climb towards it, it signals the downtrend is weakening.

- RSI - is another popular momentum indicator. Also an oscillator, the RSI acts as a metric for price changes and the speed at which they change. The indicator fluctuates back and forth between zero and 100. When RSI values are rising above 50, the signal is positive - uptrend momentum, but when the RSI hits 70 or above, it’s an indication of overbought conditions. And vice versa, RSI readings that decrease below 50 show negative, downtrend momentum. If RSI readings are below 30, though, it is an indication of possible oversold conditions.

- Average directional index (ADX) - is used to measure when a trend is gaining or losing momentum. It is calculated based on a moving average of price action over a period of time, and shown as a single line on the graph. An ADX value is 25 or over is an indication of a strong trend, and when a value is below 25 is seen as a weak trend and momentum traders will usually avoid using strategies within this range. The higher peaks on a chart show that a trend momentum is rising, whereas smaller peaks mean that momentum is entering a downtrend, which means that a trader should exit his/her position.

Momentum indicators are important tools for traders, but they are rarely used in isolation. It is more practical to use them with other technical indicators that reveal the directions of trends. Once a direction’s been determined, momentum indicators are valuable because they indicate the strength of price movement trends and when they are coming to an end.

Bottom Line on Momentum Trading Strategy

Momentum trading is not for everyone - it is risky and requires professional touch, but it has its rewards - often leads to massive profits. It takes discipline to trade in this type of style because trades must be closed at the first sign of weakness and the funds must be immediately placed into a different trade that is exhibiting strength.

Factors like commissions, rained down on momentum trading strategy and made it impractical for many traders, but low-cost brokers take on a more substantial role in the trading careers of short-term active traders. Buying high and selling higher is momentum traders' main goal, but this goal does not come without its fair share of challenges and risks.