- Analytics

- Market Overview

US stock exchanges are closed due to holidays - 5.9.2016

Weak US labour market data for August came out on Friday. Nevertheless, stocks are US dollar index advanced. Nonfarm payrolls were 151 thousand in August, below the anticipated 180 thousand. Markets believe the data will not hinder Fed rate hike as in June the reading was quite high at 275 thousand. According to Fed funds futures, the chances for September rate hike are above 20%, and for December are around 60%. After the data the chances for the December Fed rate hike even rose a bit on Richmond Fed President Jeffrey M.Lacker words that the current overnight rate is too low. The US markets are closed today due to the Labour Day holiday.

European markets are quiet today without US investors. STOXX Europe 600 index hit a fresh 8-month high on Monday. Retail sales rose in Eurozone in July by 2.9% which exceeded expectations. Software provider Temenos stocks sky-rocketed 8.4% after Credit Suisse Bank raised its stance on the stock to “outperform”. ArcelorMittal stocks soared on anxiety of G20 leaders about possible lack of steel. No more important data are expected today in Eurozone. Investors expect the results of the next ECB meeting on Thursday and its comments on European economy.

Nikkei hit a fresh 3-month high today. It rose together with other global indices. Later Nikkei corrected down after the BoJ President Haruhiko Kuroda said the further monetary easing is probable with help of new instruments. This disappointed market participants who waited more exact guidance ahead of the next BoJ meeting on September 20-21. Japanese yen rose slightly. Additional negative came from the weak composite and services PMI for August.

Oil prices rose significantly as Saudi Arabia and Russia agreed on coordinated moves to stabilize global oil market on G20 meeting. Later the Iranian president said the country was ready to raise oil production to 4 barrels a day which made oil prices retrace. OPEC members are planning to discuss oil production “freeze” on Energy Forum on September 26-28.

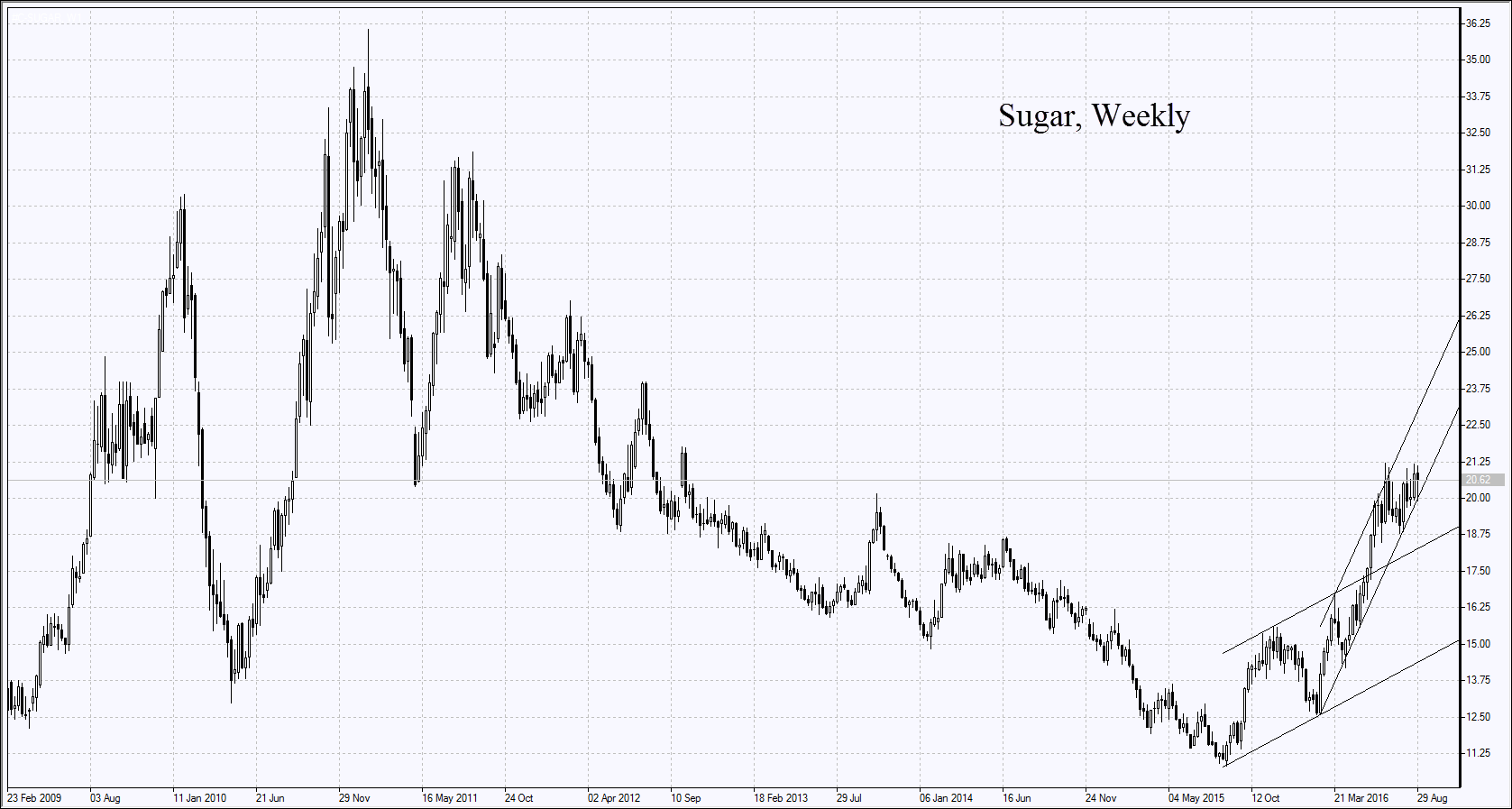

Sugar advanced on the news the Egyptian national General Authority for Supply Commodities purchased 50 thousand tonnes in Brazil. Till next February Egypt in planning to acquire 450-550 thousand tonnes of sugar in global markets.

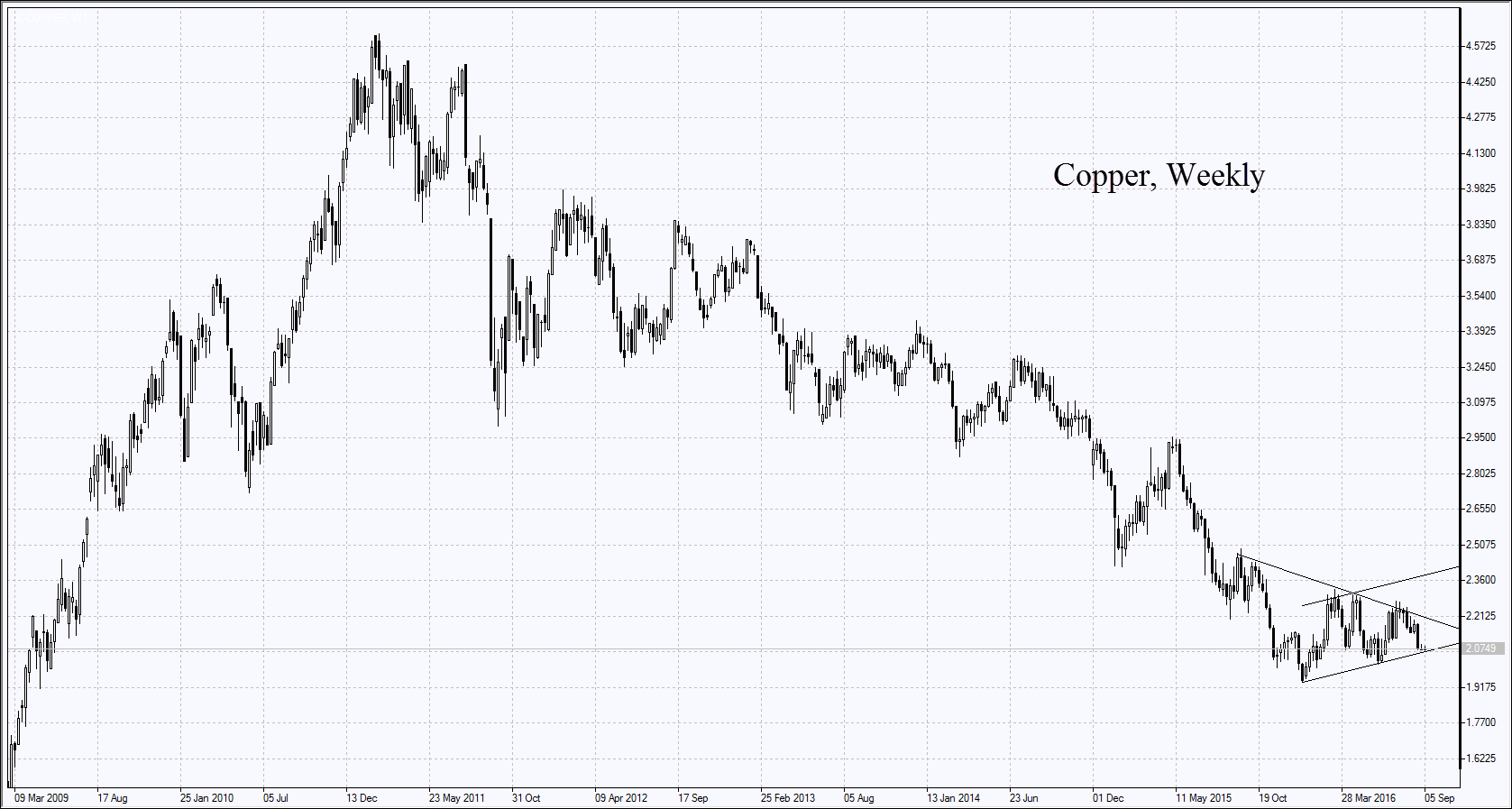

Copper is traded in a narrow range while its stocks in LME rose 60% to 328.5 thousand tonnes in a month. The external trade balance data for August China on Thursday may affect copper prices.

Gold advanced after the US Nonfarm payrolls rose in August less than expected. This makes the early Fed rate hike less probable. Moreover, market participants expect higher demand for gold in India due the wedding season. The holdings of world’s largest gold-backed ETF SPDR Gold Trust were unchanged last week while the holdings of other precious metals fell.

Trading in commodity futures markets is expected to be subdued today due to the US holiday and day-off.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Instant Execution

Ready to Trade?

Open Account