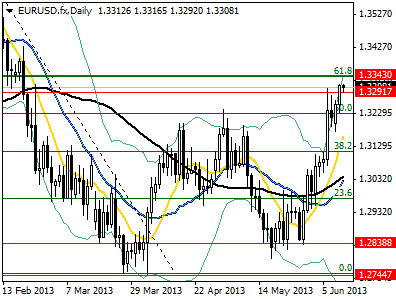

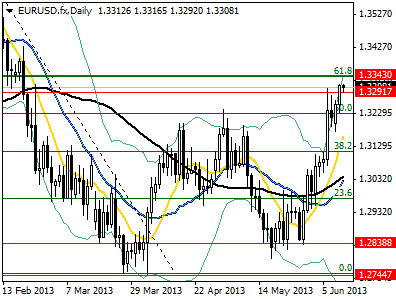

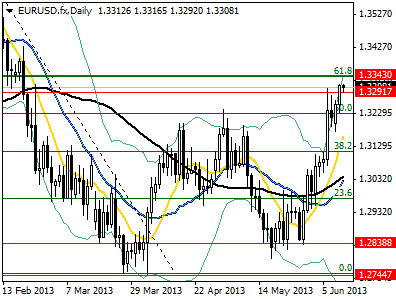

The common currency penetrated

resistance at 1.3291 and is moving towards next resistance at 1.3343, even though Greece was downgraded by MSCI from a developed country to emerging-market country and that happens for the first time ever. In addition European indices were in negative ground yesterday with FTSE 100 falling by 0.94%, DAX 1.03% down and CAC 40 declining by 1.39%. We expect the

EURUSD to find strong resistance in the area around 1.3343 since it is at 61.8% of 1.3710 to 1.2744, at 1.3343.

Concerning the Japanese Yen strengthened yesterday against the US dollar after the BOJ decision to hold monetary policy unchanged, with the USDJPY falling to support at 95.64 during late American session and then US dollar managing to recover some losses retracing early this morning to 96.91. Japanese key equity index, NIKKEI 225, dropped below 13000 level following USDJPY weakness but both were recovering together afterwards with the index closing at 13289, 0.21% lower than yesterday. Decreased speculation on tapering asset purchases by FED and funds leaving Japanese assets drove USDJPY slightly higher.

Elsewhere, the precious metal was falling in recent trading against the greenback as China continues its 3-day holiday with volume being lower than otherwise. It dipped from resistance at 1389 on Monday to support at 1366.50 on Thursday then recovering slightly, it was lastly seen at 1375. On the other hand, Aussie recovered from more than 2 ½ year low at 0.9326, bouncing up to resistance at 0.9483, underpinned today by Westpac Consumer Sentiment reported at 4.7% for June up from -7.0% in May, the first positive figure in the last 3 months.