The two day meeting of the Federal Open Market Committee ended yesterday evening with the monetary policy decided to be maintained unchanged. Mortgage backed securities purchases will continue at $40 bln per month and longer-term Treasury securities at $45 bln, carrying on downward pressure on longer term interest rates. However the Committee commented that recognizes lower risk to the outlook of the economy and the labor market than in previous meeting, sounding more hawkish and lifting the 30 year US benchmark bond yield to 3.42% from 3.32%.

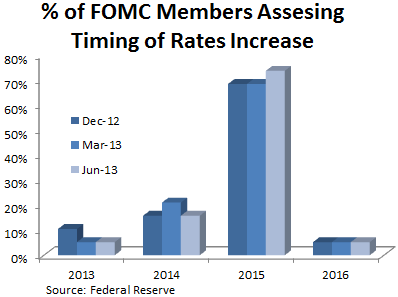

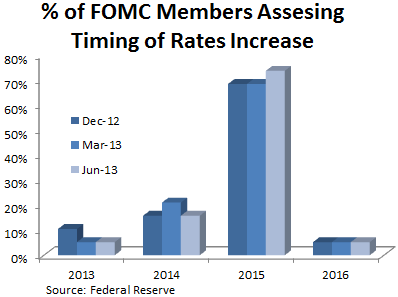

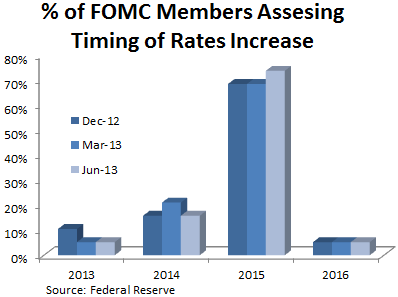

Concerning interest rate, it remains at 0.25% and is likely to remain at that level until 2015 and then raised according to the members of the Committee projections. Furthermore, projections suggest that inflation will remain below target of 2% for 2013 and around target by end of 2014 and during 2015, unemployment rate is projected to reduce below 6.5% by beginnings of 2015.

To conclude, the Statement appeared more hawkish, one more member projects rates increase in 2015, GDP outlook improves and unemployment target of 6.5% on its way with inflation below 2.5%, and lastly Bernanke said that Fed is likely to reduce bond buying pace in 2013. The US dollar reacted positively on that news, appreciating against its most peers, with

EURUSD falling to 1.3244 from 1.3416,

GBPUSD dipping to 1.5446 from 1.5674 and

USDJPY rising to 97.56 from 94.94. Also US equities dropped on risk-off with S&P 500 losing by 1.39% and

Dow Jones Industrial Average falling by 1.35%, followed by Asian shares as NIKKEI 225 reduced by 1.74%. Perhaps FEDs fundamental positive effect on greenback triggered a technical recovery since the US dollar have been in deep correction falling to 4-month low.

Looking ahead, Swiss National Bank would announce its monetary decision today as well, Euro group Meeting begins, US Unemployment Claims expected to rise slightly and European manufacturing PMIs are forecasted to indicate some improvement.