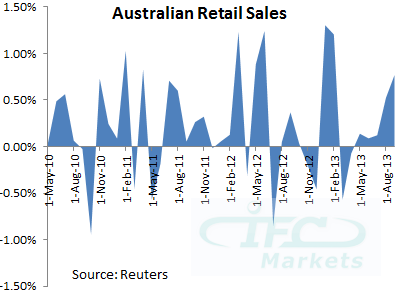

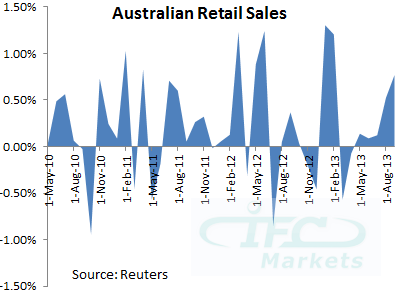

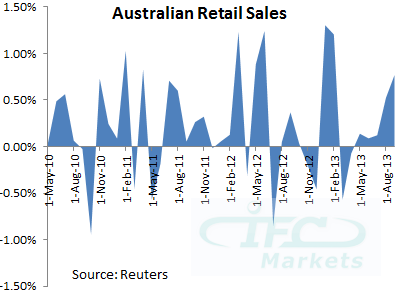

Australian Retail Sales jumped by 0.8% in September beating estimates of 0.5% and August month revised figure of 0.5%. Thus the

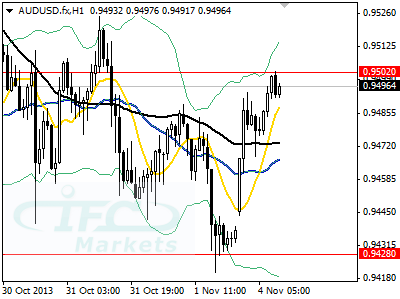

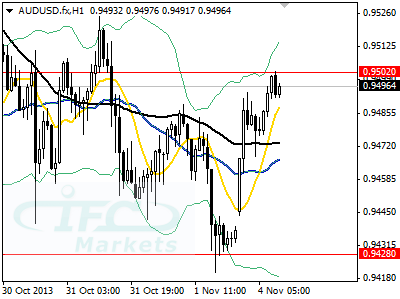

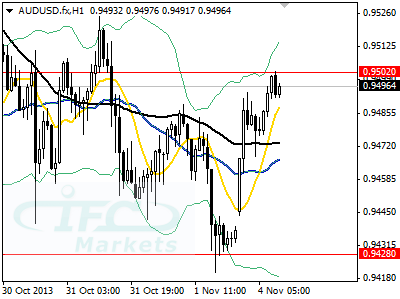

Australian dollar against the US dollar was boosted early on Monday climbing from Friday support at 0.9428 to cap at 0.9502. Moreover, the Chinese Services PMI increased to 56.3, indicating that expansion is strengthening in non-manufacturing sector in October compared to 55.4 reading in September. Traders are now turning their attention to tomorrow’s RBA release where key rate is expected to remain unchanged at 2.5% as well as upon Glenn Stevens comments on monetary path.

AUDUSD

At the same time, the

Euro sank to a more than a 6-week low early on Monday at 1.3442 against the

US dollar as the downside bias from previous week weighed on the pair. However, as of typing German manufacturing PMI was released indicating a surprising expansion at 51.7 up from expected at 51.5 and Euro-zone Manufacturing PMI stood at 51.3 in line with projections for October. The latest releases underpinned the EURUSD that recovered to 1.3508. In the daily timeframe the pair is oversold and for that reason in our opinion the pair could extend in sideways or correct higher.

On the data front, I would say Monday is soft on news, however ahead lies ECB and BOE decisions on Thursday and then Non-Farm Payrolls on Friday. Concerning equities HERTZ Global(HTZ), TOTAL(TOT) and WEATHERFORD(WFT) would report their earnings today. Chevron missed estimates of $2.71 on Friday and reported EPS at $2.57 falling on Friday session from 119.82 to 118.06.