- Analytics

- Market Overview

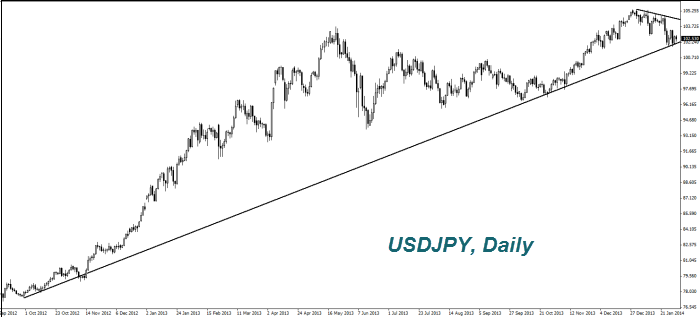

The Fed's decision nevertheless supported the dollar - 31.1.2014

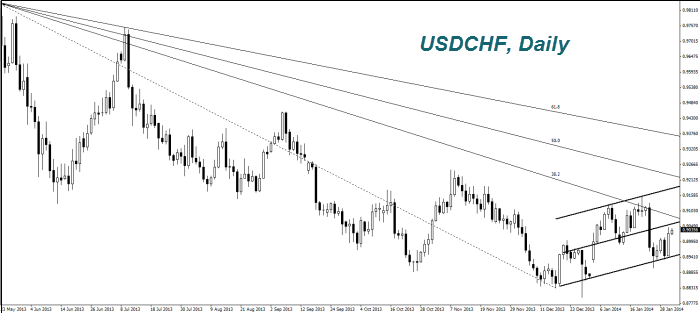

The Australian Dollar (AUDUSD) rose slightly (growth in the chart) on stopping the panic sales in the foreign exchange markets of developing countries and it should be noted that many investors do not preclude their recurrence in the future because of the Fed's steps in the market of U.S. government bonds. As we have mentioned, now “Aussie" is considered by major funds as a liquid analogue of currencies of developing market. Representatives of funds believe that his price may drop to 0.84. Next week on Monday in 00-30 GMT (0)/ we expect the real estate market and there are important macroeconomic data for Australia coming out on Thursday. Today at 13-30 GMT (0), we expect the Canadian GDP for November to be released. In our opinion, the preliminary forecast is neutral. However, the Canadian Dollar has fallen by 5% since the beginning of 2014 (growth in the chart). If the GDP grows is more than expected 2.6% per annum or 0.2% per month, then we can not exclude Loonie strengthening (downward correction in the chart).

The price of Cold (XAUUSD) decreased on the economic growth in the United States. As we have noted in their reviews, the Gold is regarded by investors as a defensive asset. It is more expensive in case of deterioration of the economic situation in the world. An additional negative factor for Gold has been the decline in its sales in China because of the weekend during the celebration of the Lunar New Year, which will last from today until February sixth. Now the premium to the Gold price in China compared to London fell to $ 4 per ounce compared to $ 20 at the beginning of the year. Investors do not exclude the Gold price decline to $ 1,200 per ounce.

News

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

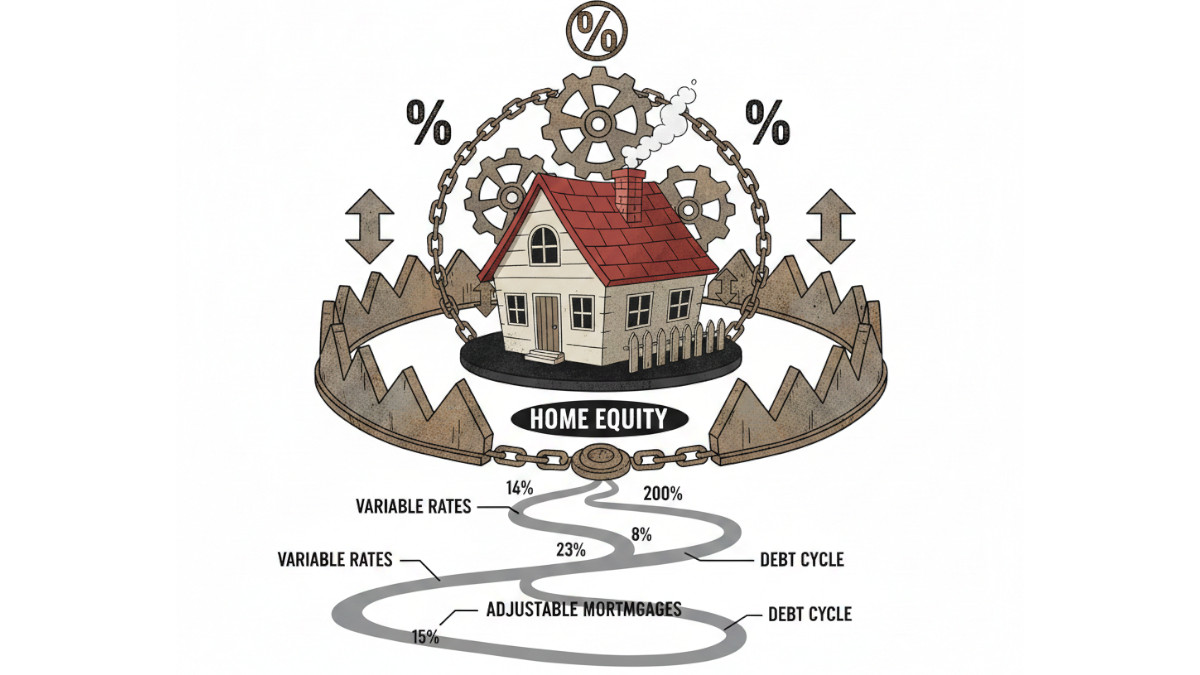

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also