- Analytics

- Market Overview

The U.S. economic data on Monday helped the USD strengthening - 15.4.2014

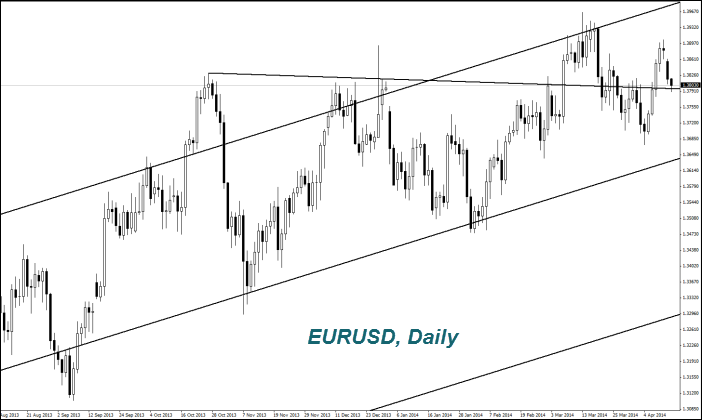

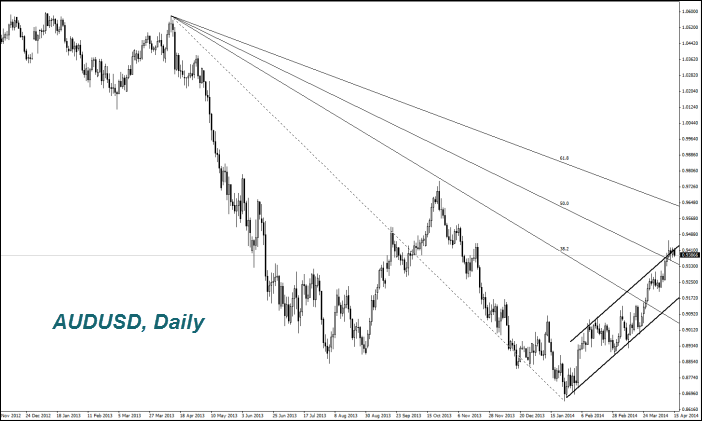

The Euro (EURUSD) demonstrated weakening (fall in the chart) after the statements by the ECB head, Mario Draghi on possible beginning of the QE new phase (money issue). Today at 13-30 CET, the ZEW index of economic activity in the EU and Germany for April and the Eurozone trade balance for February will come out. In our opinion, the preliminary forecast is positive if European investors do not submit unjustified negative emotions over Ukraine. Their opinion is taken into account while the ZEW index gets compiled. The Japanese Yen (USDJPY) remained stable thanks to the head of the Bank of Japan, Haruhito Kuroda that stated there are no plans for additional measures to mitigate the monetary policy (higher emissions). Recall that the sales tax was increased from 5% to 8% on April 1st. A significant part of market participants believed that Japan will still increase the emission volume in order to support their major corporations and increase inflation to the target level of 2% later this year. Recall that the next BOJ meeting will be held on April 30th. Tomorrow morning at 8:30 CET we will see the Industrial Production for February and the regular BOJ press conference is to be held at 10-15 CET. The Australian Dollar (AUDUSD) slightly decreased, which means its weakening. Thus investors reacted to the early April RBA meeting minutes publication. They assumed that the current level of low interest rates at 2.5% will be kept for a long time. The economic slowdown in China may be additional negative factor for the Aussie as China is the main trading partner of Australia.

Tomorrow at 6-00 CET we will find out about Chinese GDP for the first quarter. Its growth is expected to slow down to 7.3% from 7.7% in the fourth quarter. The GDP growth may slow down to 1.5% from 1.8%. This morning, we observed the negative economic information about reducing the yearly volume of new loans from the People's Bank of China by 19% and the minimal growth of the money supply. After this, the forward contracts on the Yuan fell to the lowest level of eight months. We recommend the following Chinese statistics to those traders who trade commodity futures. The weak data may trigger a downward correction.

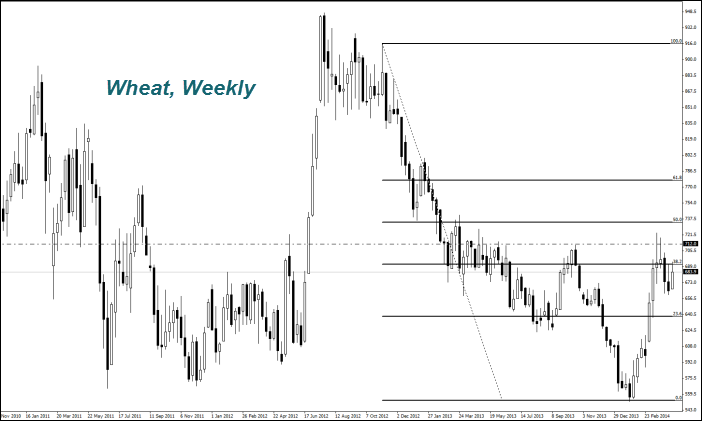

The Wheat prices increased as new Ukrainian authorities are poorly financed farmers in conditions of aggravation of the political situation in Ukraine. Another negative factor was the drought. Agritel lowered the wheat harvest forecast in Ukraine for this year by 1.6 million tons to 18.4 million tons and by 1.8 million tons to 48.1 million tons for Russia (due to the drought). The Corn prices fell slightly. There was 3% of the new crop seeds planted at the end of last week in the United States. This coincides with the USDA prediction in spite of the cold weather. If the weather conditions get improved planting seeds can be up to 10% of the daily total.

News

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Oil Prices Stay Weak After OPEC+ Approves Modest Output Rise

Oil prices ended the week on shaky ground after OPEC+ approved a modest production increase of 137,000 bpd, signaling cautious...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also