- Analytics

- Market Overview

Today most financial markets do not work due to "Good Friday" - 18.4.2014

Quotes of the Canadian Dollar (USDCAD) remained almost unchanged as inflation rose slightly in March and almost coincided with the forecast. Some separate inflation indices showed a clear growth. This increases the likelihood of rising in interest rates and supports the CAD. The Bank of Canada raised its own inflation forecast for the entire first quarter from 0.9% to 1.3%. It reaffirmed the commitment to raise this figure up to 2% by the end of next year, and kept it acceptable range at (1%-3%). The Governor of the Bank of Canada, Stephen Poloz said yesterday that the March inflation increase is temporary and its general trend is neutral.

The quotes of the Soyb rose to the 10-month maximum, due to the record high domestic demand in the United States. This country is the second largest exporter of beans. Consumers fear the decrease in supply amid rising domestic consumption. According to the National Oilseed Processors Association, the soybean purchases in March increased by 12% compared with last year and reached the highest level since 1998 amounting to 153.8 million tons. The USDA lowered its forecast for U.S. soybean stocks at the end of August by 10 million tons to 135 million tons. This is 4.2% below the last year's level. Meanwhile, the Soyb market also has negative factors that may affect the quotes in the future. China may refuse to buy up to 5 million tons of soybeans from the United States. The main reason for this is the sharp demand decline due to the mass destruction of Chinese poultry which has previously been identified with avian influenza. Soybean is the main feed for broiler chickens. Recall that last year China imported 63.4 million tons of beans. This is just about 60% of the world market. Earlier this year, China turned away from the purchase of 500 tons of Brazilian soybeans, for the first time in 10 years.

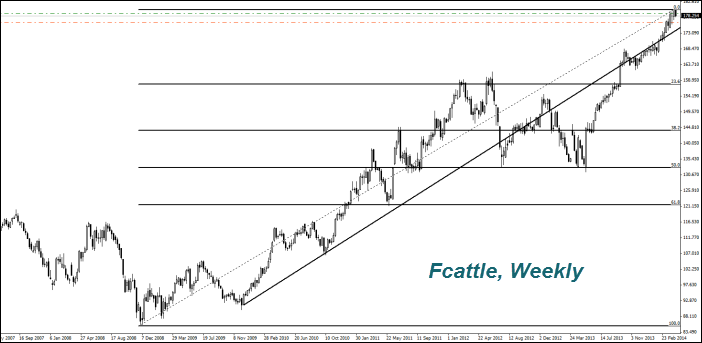

We do not rule out a downward correction of futures prices for frozen beef (Fcattle). The U.S. Department of Agriculture (USDA) said that the beef price will go up by 4% in 2014 and it already has grown since the beginning of the year by almost 8%. Some market participants do not exclude any USDA steps to settle the situation. Now the total number of cattle in the U.S. is at the minimum since 1951 and the country imports meat. We do not exclude that it may happen because of subsidies to farmers for growing the biofuel crops.

News

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Oil Prices Stay Weak After OPEC+ Approves Modest Output Rise

Oil prices ended the week on shaky ground after OPEC+ approved a modest production increase of 137,000 bpd, signaling cautious...

Slowing U.S. Growth Put Spotlight on CPI as EURUSD

Weak PMI data, softening jobs market, and political brouhaha raise the stakes for October’s inflation print. The U.S. government...

Bitcoin Eyes $145,000, But a Pullback May Come First

Bitcoin has been making strong moves again. The world’s largest cryptocurrency climbed to a six-week high of $119,500 on...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also