- Analytics

- Market Overview

The decrease occurred again in spite of positive U.S. economic data - 25.6.2014

Yesterday the world stock markets, except Japanese continued to decline. And it happened in spite of positive U.S. economic data again. The index of consumer confidence rose to its highest level in six and a half years and was 85.2 points.

The new home sales in May increased by 18.2% and reached a maximum of six years (504 thousand). This is the largest increase for the month since January 1992. In fact, these two economic indicators rose yesterday to pre-crisis levels of January and May 2008, respectively. The prices for the U.S. homes within12 months (May to May) increased by 10.8%. Investors believe that the U.S. housing market is still far from overheating. American economists explain yesterday's decline in quotations by the situation Iraq and the results of negotiations between the U.S. Secretary, John Kerry and the leaders of the Kurds. They believe that the likelihood of entering the U.S. troops in Iraq is increased. We, in turn, do not rule out the desire of the market participants to take profits on stocks after many months of continuous growth of indexes. In this case, a downward correction may continue regardless of the situation in Iraq. Note that the Oil prices ignored the negotiations. The trading volume on the U.S. exchanges yesterday was 5.69 billion shares, which is 1.4% higher than the average monthly level. The shares of General Electric and Boeing continued to decline, which we wrote about in the previous review, notting the negative. Another factor was the partial suspension in activity of the Export-Import Bank of the United States until September 30. Its employees are suspected of bribery. This can damage the activities of large companies with a large share of exports. Boeing said that if the bank does not start to work, around 1.5 million jobs will suffer. Today, we will see the important economic information from the U.S.: Orders for durable goods in May and the first quarter GDP in the third reading at 12-30 CET. In our opinion, the forecasts are negative for U.S. stocks. Now, the European stock markets and U.S. futures are traded negatively.

European stocks fell for a fourth day in a row, which was the longest decline within seven weeks. This contributed to the weak performance of the business and economic confidence of (IFO) in Germany, as well as negative news for some European companies. In general, we believe that the stock markets of Europe will react to the situation around Ukraine more sharply. There are no important information expected from the EU for today .

The Nikkei has grown due to the positive press conference of the Prime Minister, Shinzo Abe. He announced the Three Arrows plan aimed at maintaining the economic growth in the country: the reduction of corporate taxes, changes in corporate governance and increased labor immigration. Today, we will see a minor economic information in Japan. The Important data on inflation and unemployment are expected tomorrow.

The BEEF refreshed its new historical highs on the the beginning of the so-called summer Grill Season in the United States. The wholesale fresh meat price was $5.25 per kg. The USDA does not specifically comment this situation, but notes that the number of cattle in the country is the lowest with 63 years and amounts to 87.73 million now. Therefore, market participants believe that prices may remain near the maximum levels during the whole 2014. Unless, the drought does not get stronger, as this may lead to slaughtering due to lack of food.

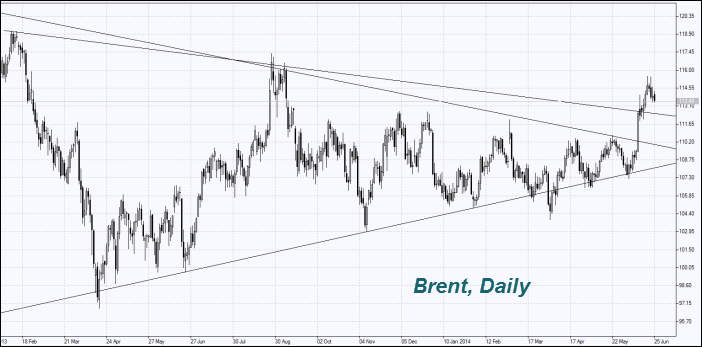

The European Brent price fell and the U.S. (Oil) has grown. The U.S. crude inventories increased by 4 million barrels, but it did not affect the prices. Since the U.S. authorities allowed private companies to export gas condensate (ultra light oil) from the United States. Its production in the country is 800 thousand barrels per day. The OPEC General Secretary,Abdullah al-Badri said that the recent growth of quotations above $114 per barrel was because of a nerves of investors. Saudi Arabia is now producing 9.7 million barrels a day, but is able to increase its production to 12.5 million. According to the OPEC head , it is not necessary. Since the oil reserves of developed countries - consumers cover 57.5 days. That they should be used and in the case of sudden bursts of market quotations.

News

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also