- Analytics

- Market Overview

U.S. positive macroeconomic data released causing poor market reaction - 31.7.2014

World stock markets had no single trend on Wednesday. U.S. positive macroeconomic data came out, but investor reaction to the data appeared to be weak, due to the increased possibility of the rate hike. An additional negative factor for global markets could also be a possibility of Argentina falling into default.

U.S. GDP for the second quarter boosted 4%. It is considerably higher that expected. Decline in GDP for the first quarter has been reviewed from -2.9% to -2.1%. The total growth of the American economy made up +1.9% in the first half of the year. Employment Change in July increased by 218,000, according to ADP agency. This is slightly worse than expected, but higher than the key level of +200,000, a state in which the labor market is now considered to be balanced. Fed kept the discount rate at 0.25% on Wednesday, and has reduced the ‘QE3’ program by $10 billion to $25 billion in monthly terms. At the moment, the majority of investors believe that the first rate increase could occur in June 2015. This event is possible to happen due to positive macroeconomic data. It had a very positive influence on the U.S. dollar rate, and slowed down the stock quotes growth. Trade turnover on American stock exchanges was 11% higher than the average for the month. Negative earnings reports on such companies as Whole Foods Markets and Akamai Technologies were released after trading hours finished. Today at 12-30 CET, we expect the release of weekly data on the U.S. labor market, and at 13-45 CET - PMI in Chicago. In our opinion, their forecasts are negative. Futures on American stock indices are now "in the red".

European stock indices slipped yesterday, following the political tension in Ukraine and negative earnings reporting. Adidas, sportswear manufacturer, lowered its profit forecast for the current year and its stocks tumbled 9.7%. Construction companies HeidelbergCement and Holcim published their weak quarterly reports. In Portugal, Banco Espirito Santo stocks collapsed 10%, the bank which we wrote about earlier, and the retailer Jeronimo Martins stocks fell in price as well. Weak data on the labor market in Germany for July came out this morning. European indices decline continues. At 9-00 CET the data on inflation and unemployment will be announced in Eurozone. The outlook is neutral.

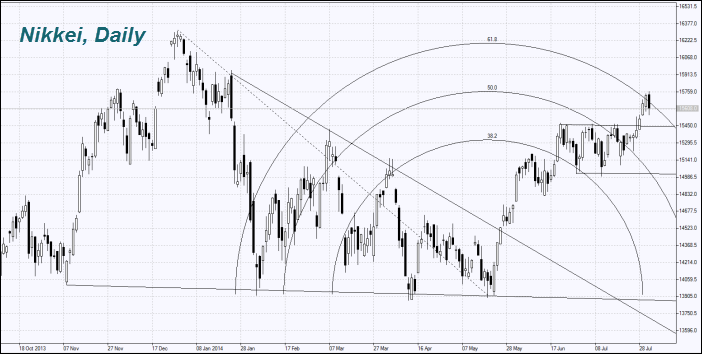

Nikkei updated its annual high yesterday. Investors believe that the income of Japanese exporters is to be increased, due to the American economy recovery and US GDP growth in the second quarter. A possible increase in American discount rates yesterday contributed to four-month high daily strengthening of the dollar against the yen. Today, Nikkei is dropping in line with the global trend, and also due to poor earnings report of Nintendo caused by lower sales of Wii U game console. At 1-35 CET Japanese PMI for July by Markit is to be released tomorrow early morning. Haruhiko Kuroda, current Governor of the Bank of Japan, is giving a speech at 3-30 CET.

Oil prices fell considerably. This trend fits well into the logic of the economic sanctions of Western countries on Russia, since the share of hydrocarbons in Russian exports outperforms 70%. US oil reserves have reduced by 3.7 million barrels this week as gasoline inventories were increased to the six-month high; diesel reserves and fuel oil - up to a maximum since September of 2013. US oil exports reached its high in 15 years and amounted to 288,000 barrels per day (bpd) in May. Meanwhile the bulk of the raw materials is supplied to Canada. The volume exported to European countries is only 25,000. bpd, but this volume is expected to be raised. OPEC increased oil extraction by 140,000 bpd to 30.06 million bdp in July.

Coffee and cocoa prices have continued to grow. This year Brazilian exporter Terra Forte lowered its coffee crop forecast to 45.8 million. bags (60 kg) from 47.4 million bags in February. However, the estimates of the total reserves at the beginning of July amounted to 8.2 million. bags, which is less than the government outlook of 15.2 million bags. Chocolate manufacturers point out an increase in cocoa demand. According to Bahia Commercial Association, in Brazil, in late July, it increased by 72% compared to the same period last year.

News

Crypto Liquidations Domino Effect

Crypto market just went through a sharp sell-off over the weekend Bitcoin briefly fell below key support level before bouncing...

Paramount Skydance is After CNN

Paramount Skydance is going after Warner Bros. Discovery. They’ve filed a lawsuit in Delaware and are getting ready to...

GM and Ford Are Pulling Back From EVs

General Motors and Ford are quietly stepping back from the aggressive EV plans they were pushing just a few years ago. This...

PayPal Partners with OpenAI and Applies to Become a Bank

PayPal has been under a lot of pressure for a while now: there was a rising doubt if paypal can even still compete with Apple...

The Road to Hell is Paved with Good Intentions: 10% Credit Card Interest Rate Cap

As of January 2026, there is a proposal to cap credit card interest rates at 10% nationwide. The idea is to help Americans...

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also