- Analytics

- Market Overview

World stock indices rose on Monday due to partial stabilization of political situation in Ukraine - 26.8.2014

World stock indices rose on Monday, due to the partial stabilization of the political situation in Ukraine after the delivery of the Russian humanitarian aid to the south-eastern part of the country. At the same time market participants did not have any reaction on the negative macroeconomic data. The US New Home Sales for July slipped 2.4% as compared to June, and it appeared to be lower than expected. Note that the index added 12.3% as compared to July 2013. The German Ifo Business Climate Index in August proved to be weaker than the tentative forecasts. However, S&P 500 renewed the historical high.

The financial sector stocks climbed amid the expectations of the early start of the European economy monetary incentive. Morgan Stanley quotes upped 2.2%, Goldman Sachs Group – 1.4%, Bank of America - 1%. The stocks of the fast food chain Burger King boosted 19.5%, due to a possible takeover of the Canadian coffee chain Tim Hortons Inc. As a result, Burger King may obtain the tax residence in Canada, where there is a lower fiscal pressure than in the United States. The volume of trading on the US stock exchanges still remains very low. Yesterday it was 4.07 billion stocks, which is 26% lower than the monthly average level. The US Durable Goods Orders in July is to be released today at 12-30 CET; at 14-00 СЕТ – Consumer Confidence Index in August. The outlook of the first indicator seems to be positive, and the second – negative. As a result, futures on American stock indices are now traded "in the sideways".

European stocks are sagging today, after the rapid boost they had yesterday. We assume that this decrease is due to the negative information on some of the companies. There is no macroeconomic data released in the EU and Japan for today. Nikkei is falling along with the European indices.

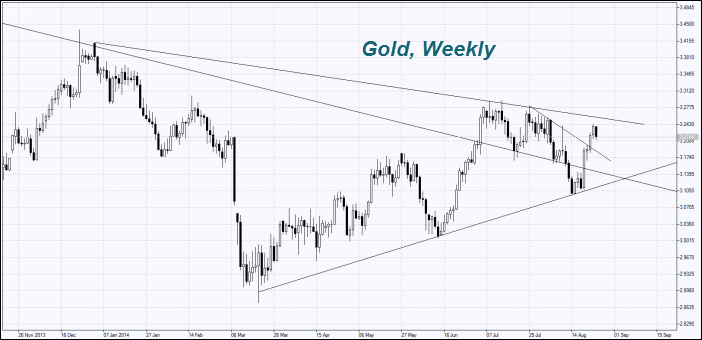

Gold prices are rising today amid the downward correction of European and Asian markets, and the dollar index fall. Most investors consider it to be "technical" and do not count on its long-term continuation. According to the world largest gold fund SPDR Gold Trust, its gold inventories decreased 3 tons on Monday, as compared to Friday and reached 797.1 tons. Net gold imports into China via Hong Kong fell in July to a three-year low. Chinese jewelers rely on the price drop, and do not hurry to purchase the physical metal.

Chilean copper producer Antofagasta published a weak earnings report for the first half of the year. The company’s profit narrowed 11.5%. We believe that market participants made use of this news as a reason to take profits after a four-day of continuous growth. Accordingly, copper prices are falling today.

Coffee prices jumped. National Coffee Council expects to reduce its crop in Brazil the next year to 40 million tons and lower. The Brazilian coffee production slipped 3.1% in 2013, and in 2014 - 18%. The crop reduction for three consecutive years is observed for the first time since 1965, and this happens due to the drought. Note that the USDA does not expect the global coffee deficit due to increased production in other countries. In particular, the highest possible crop since 2008 is expected in Colombia. As International Coffee Organization reported, there will be the world shortage of coffee of 10 million bags this year. According to International Coffee Organization, this may happen due to the low level of global reserves at the beginning of the year, amounted to only 40.1 million bags. We believe that due to all these various forecasts, coffee prices are in the sideways trend since early August.

According to the Australian Bureau of Meteorology, the probable expansion of hurricane El Niño is 50/50. Let us note if it happens, the agricultural commodity futures can show a significant growth of the multi-month lows they are staying now. Note that El Niño appears usually once every three - five years and begins at the end of September. It has been gone for four years.

News

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

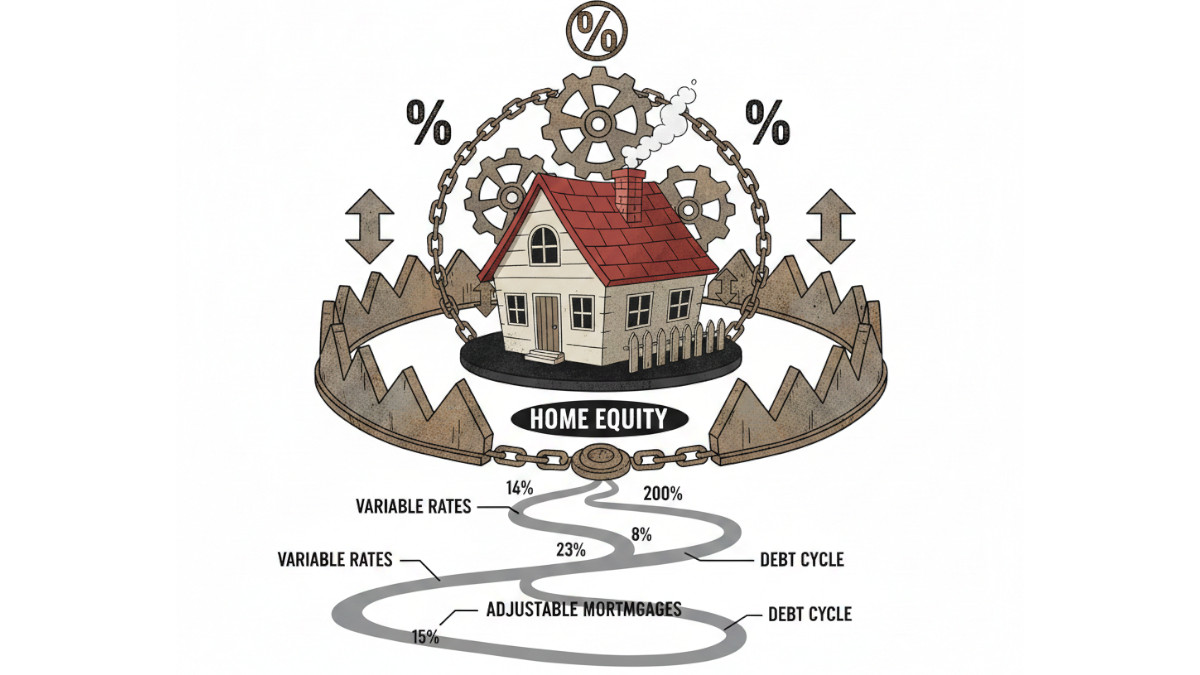

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Oil Stocks and OPEC’s Credibility Problem

At the end of November, OPEC announced it would keep oil production flat through the first quarter of 2026. Historically,...

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also