- Analytics

- Market Overview

US macroeconomic indicators much better than expected yesterday - 29.8.2014

World stock indices sagged on Thursday, due to political situation aggravation in Ukraine. The performance of all the macroeconomic indicators appeared to be much better than expected. The GDP for the second quarter in the second reading was revised upward from 4% to 4.2%. This has been the highest increase since the third quarter of 2013.

The US Initial Claims dropped for the second week in a row, though an increase was expected. Pending Home Sales in July upped 3.3% and reached the 11-month high. The volume of trading on US stock exchanges still remains quite low. Yesterday it made up 4.16 billion stocks, and that is 22% lower than the monthly average. Note that the trade volume has not outperformed 5 billion stocks for 8 consecutive trading sessions. This happens for the first time in the last 6 years. The US Personal Income and Spending in July is to be released today at 12-30 СЕТ. Chicago PMI is to be announced at 13-45 CET, and Consumer Confidence Index in August by the University of Michigan – at 13-55 СЕТ. In our opinion, the outlooks are positive. Moreover, the rumors about the invasion of Russian troops in Ukraine were not confirmed. Currently, the futures on US stock indices are traded “in the black” and the Dollar Index is rising. Let us remind you that the US financial markets will be closed on Monday due to the holiday, Labor Day.

European stocks are also increasing now amid the contradiction of the Ukraine situation aggravation. The important data on inflation in August and unemployment in July will be released today at 9-00 СЕТ in the EU. According to the forecasts, it has remained unchanged compared to the previous data. We assume that the significant price movements are possible, if the reality does not match with the expectations of market participants. According to these parameters, the ECB will carry out the possible monetary policy easing. Moreover, it contributes to the euro depreciation. Note that the ECB meeting will be held on Thursday.

Nikkei follows the trends of other world indices, and is growing now after the drop occurred yesterday. The Japanese macroeconomic indicators appeared to be not as weak as expected yesterday. The July inflation remained at the June level of 3.3%. The retail trade turnover has grown. The unemployment indicator performance outperformed insignificantly the outlook. The industrial production growth in July appeared to be underestimated compared to the forecasts, but the fact of its increase was favorably received by market participants. Japan’s Ministry of Commerce expects the industrial production to add 1.3% in August, and another 3.5% in September.

Let us remind you that currently the Bank of Japan stimulates the economic growth at the expense of yen issue and has the QE3 program like the one of the US Fed. The ECB plans to join them. The Fed is going to complete the US dollar issue in October. The dollar index was the first one to rise in mid-May. The euro started to weaken considerably in June after the “Ukraine events” began to have an impact on the European economy. The yen depreciation happened later, only in July, when the 6-month data revealed that the monetary stimulus did not lead to the Japanese economy growth. We do not leave out the continuation of current trends in the Forex market.

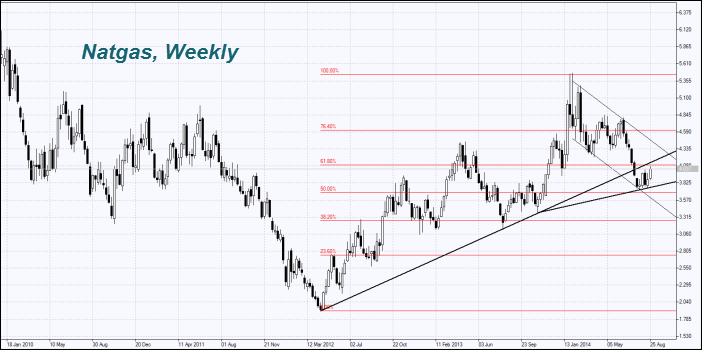

Let us note a good increase in natural gas prices. We pointed out in previous overviews that the gas prices are supported by the high cost of the US shale gas production, and by high demand for liquefied natural gas (LNG) in Asia and partly in Europe. The investment bank Morgan Stanley announced its plans to build an export terminal based on a new technology "compressed natural gas» (CNG). According to the bank calculations, the cost will be much lower than for the supply of the LNG. Note that the gas price in Southeast Asia is about four times higher than in the United States.

As expected, an increase of almost all the agricultural futures prices is observed. It can be regarded as a "technical correction" after a powerful fall, which began in May with the sale of state grain inventories, cotton and some other products in China. This correction takes place amid the objective, but not very significant deterioration of weather conditions in some countries. The Ukraine situation aggravation contributes to the wheat prices growth.

News

Iran Currency Collapse and BRICS Stress Test

So, here is what we have; Iranian Rial basically collapsed in early 2026. And it’s happening because the currency is failing,...

How Big Corporations Legally Avoid the 21% Tax

The U.S. corporate tax rate is officially 21%. In theory, that is what profitable companies are supposed to pay. But in practice,...

Trader Makes $410,000 Betting on Maduro’s Removal

An unknown slick trader made $410,000 in profit by betting that Venezuelan President Nicolas Maduro would be ousted (kidnapped...

Stablecoin Supercycle - A Threat to Traditional Banking

The rise of stablecoins could change how global finance works. What started as a market worth about $200 billion is expected...

The 2026 Rate Trap

The Federal Reserve just cut interest rates for the third time, bringing them to a range of 3.50% - 3.75%. However, investors...

AI That Steals Faster Than You Can Audit

The era of manual auditing in DeFi is ending. GPT-5 and Claude's can autonomously identify and exploit vulnerabilities in...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also