- Analytics

- Market Overview

US nonfarm payrolls in focus - 8.12.2017

US stock market recovers

US stock indices recovered on Thursday led by technology and industrial shares. The dollar strengthening persisted: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.2% higher at 93.524. Dow Jones industrial average added 0.3% to 24211.48. The S&P 500 rose 0.3% to 2636.98. The Nasdaq outperformed gaining 0.5% to 6812.84.

Developments in US tax bill negotiations are the main drivers of recent stock market moves. The Senate late Wednesday agreed to begin formal negotiations with the House, spurring hopes the final tax overhaul will be completed by December 22. Today investors will focus on nonfarm payroll report due at 14:30 CET, the outlook is positive for dollar.

European stocks edge higher

European markets ended marginally higher on Thursday led by telecom and utility shares. The euro extended losses against the dollar while British Pound rose. The Stoxx Europe 600 index added 0.03%. Germany’s DAX 30 rose 0.4% to 13045.15. France’s CAC 40 gained 0.2% while UK’s FTSE 100 dropped 0.4% to 7320.75. Indices opened mixed today.

Losses in healthcare and materials stocks dragged markets as positive data and fresh hopes German coalition government talks may get renewed buoyed market sentiment. The head of the German Social Democratic Party said he’s open to discussing a renewal of a grand coalition to govern the country. The SPD’s three-day party conference began Thursday. Data Thursday indicated the euro-zone economy recovery continues: Eurostat reported the final reading on third quarter GDP came in at 0.6%, in line with expectations.

Chinese trade data support Asian indices

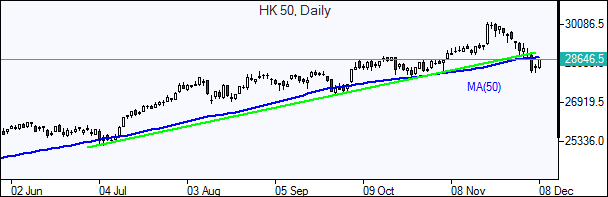

Asian stock indices are higher today on strong Chinese data. Nikkei jumped 1.4% to 22811.08 helped by continued yen weakness against the dollar. Chinese stocks are rising after report exports surged 12.3% in November from a year earlier, more than double the forecast, while imports climbed almost 18%: the Shanghai Composite Index is 0.7% higher and Hong Kong’s Hang Seng Index is up 1.2%. Australia’s All Ordinaries Index is up 0.3% with Australian dollar little changed against the greenback.

Oil up on strong China import

Oil futures prices are edging higher today on report China’s crude oil imports rose to 9.01 million barrels per day in November, the second highest on record. Prices rose yesterday: Brent for February settlement rose 1.6% to end the session at $62.20 a barrel on Thursday.

News

JPMorgan Data Fees And Why Europe’s PSD2 Got It Right

When Bloomberg and Reuters reported that JPMorgan Chase plans to charge fintech companies for access to customer bank-account...

DOGE Shutdown

Elon Musk and Donald Trump nicely leveraged public ignorance around the Department of Government Efficiency (DOGE) and Dogecoin...

Copper Price Analysis

Copper, often referred to as the metal of civilization, plays a pivotal role in various industries, including construction,...

Soybeans Price Analysis - Trends and Drivers

Soybeans have experienced significant price fluctuations over the past decades. From the 1970s through the early 2000s, soybean...

Warren Buffett Adds $521 Million to Chevron

Berkshire Hathaway made one of its biggest stock purchases last quarter, adding nearly $521 million worth of Chevron (CVX)...

BTCUSD Analysis: Trump Walked Back Massive Tariffs on China

On Monday, Bitcoin stabilized at $115,000 after last week's sharp selloff, as Trump backed down on his threat to impose massive...

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open AccountSee Also