- Analytics

- Technical Analysis

Cocoa Technical Analysis - Cocoa Trading: 2018-08-24

Ghana pest outbreak bullish for cocoa price

Cocoa pod eating worm outbreak in Ghana is bullish for cocoa price. Will the cocoa price continue rising?

Ghana cocoa harvest may suffer significant loss as a pod-eating warm outbreak has developed in southwestern regions of the country. Ghana is the second top world cocoa exporter, producing about 20% of global cocoa bean output. Southwestern region accounts for about 55% of country’s cocoa production. Lower expected cocoa crop in the world’s No. 2 producer of the commodity is bullish for cocoa price.

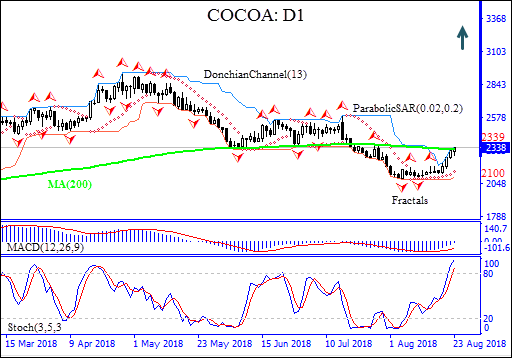

On the daily timeframe the COCOA: D1 has been rising and is currently testing the 200-day moving average MA(200).

- The Parabolic indicator has formed a buy signal.

- The Donchian channel indicates uptrend: it is tilted up.

- The MACD indicator gives a bullish signal: it is below the signal line and the gap is narrowing.

- The Stochastic oscillator is in the overbought zone, this is bearish.

We expect the bullish momentum will continue after the price breaches above the upper Donchian bound at 2339. A price above that level can be used as an entry point for a pending order to buy. The stop loss can be placed below the lower Donchian bound at 2100. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (2100) without reaching the order, we recommend canceling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Buy |

| Buy stop | Above 2339 |

| Stop loss | Below 2100 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.