- Analytics

- Technical Analysis

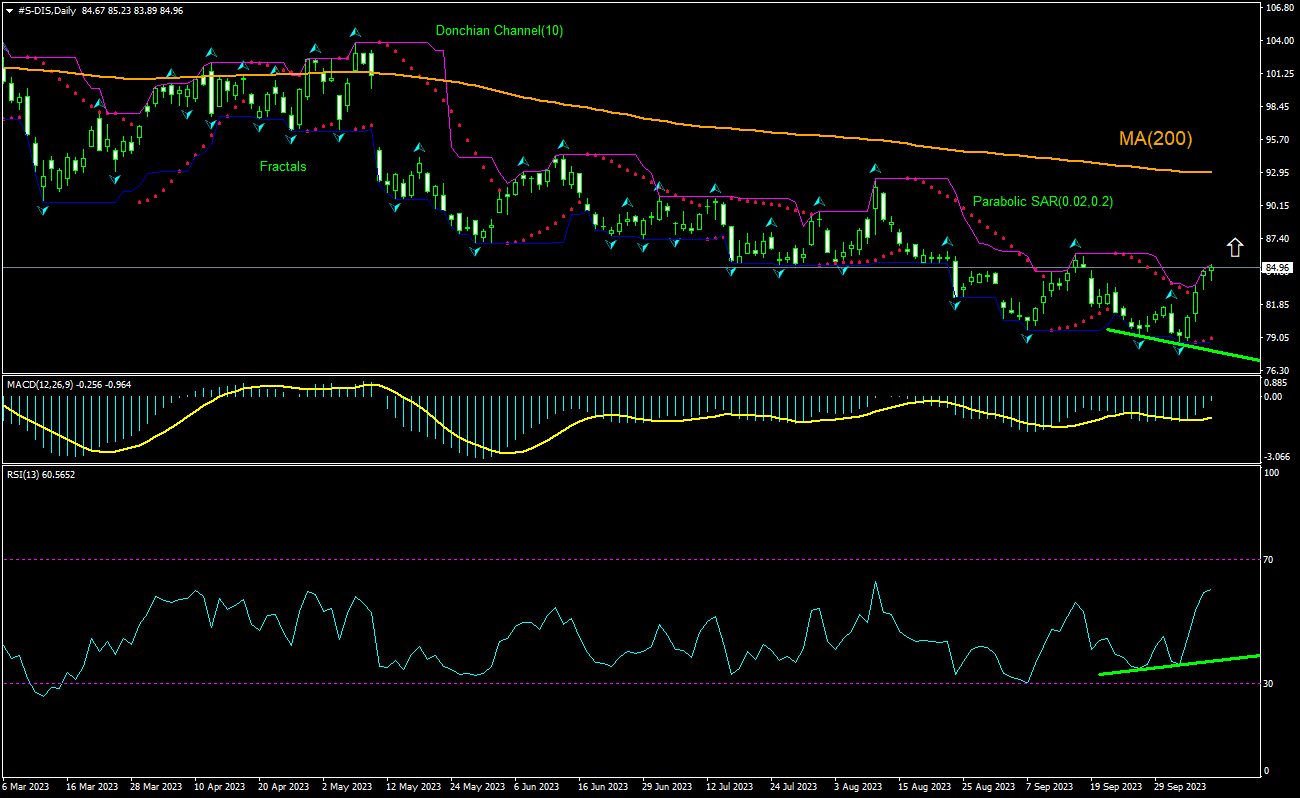

Walt Disney Technical Analysis - Walt Disney Trading: 2023-10-11

Disney Technical Analysis Summary

Above 85.23

Buy Stop

Below 78.69

Stop Loss

| Indicator | Signal |

| RSI | Buy |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Sell |

| Fractals | Neutral |

| Parabolic SAR | Buy |

Disney Chart Analysis

Disney Technical Analysis

The technical analysis of the Disney stock price chart on daily timeframe shows #S-DIS,Daily is rebounding after hitting nine-year low a week ago and is rising toward the 200-day moving average MA(200). The RSI has formed a bullish divergence. We believe the bullish momentum will persist after the price breaches above the upper boundary of Donchian channel 85.23. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 78.69. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (78.69) without reaching the order (85.23), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Stocks - Disney

Disney stock price rose after reports activist billionaire who pressured company to cut costs has boosted stake in company. Will the Disney stock price persist advancing?

Trian Fund Management led by billionaire investor Nelson Peltz has amassed a 30 million share stake in the media and entertainment group. The fund reportedly has increased its holding to roughly $2.5 billion in Disney stock and seeks not one but several boardroom seats. Nelson Peltz said his proxy fight against Disney was over in February as Disney CEO Bob Iger sought to reassure him that Disney’s $5.5 billion in budget cuts and elimination of 7,000 jobs were progressing quickly. In the past couple of years broadcast television and cable businesses have been in secular decline against the backdrop of ongoing challenges for the overall movie industry and slowing growth in the company's streaming segment. And recently a high-profile spat with the government of Florida was added to the list of challenges. Analysts speculate Peltz may be calling for breaking up Disney. Earlier this year Iger said at Sun Valley conference ABC and Disney's other linear networks "may not be core." Analysts mention that for an activist shareholder like Peltz, the goal of moves to sell these networks would be to improve the stock price and make sure Disney follows through on a plan to pay dividends. Activist investor’s pressure to improve return on assets is bullish for a company’s stock price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.