- Analytics

- Technical Analysis

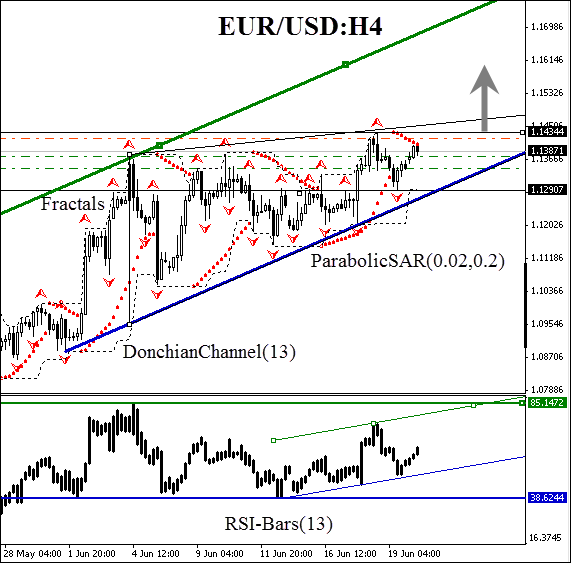

EUR/USD Technical Analysis - EUR/USD Trading: 2015-06-22

Eurogroup meeting

Let us consider the EUR/USD currency pair on the H4 time frame. The price has been consolidated within a bullish triangle: market participants are looking forward to the Eurogroup decision. We remind that today eurozone finance ministers have been discussing the greek problem in Brussels. At the moment debt restructuring is impossible due to the insufficient reform plan, proposed by the Greek government. Negotiators have been looking for a compromise. The current consolidation has been notable for the contradictive ParabolicSar and Donchian signals. The RSI-Bars oscillator has in turn shaped a bullish trend channel. The price has been moving closer to the support line on the chart. Some uncertainty persists in the market.

We believe that all the represented analysis tools have been giving bullish signals. Parabolic have been approaching to the price, making a rebound more likely. It may happen as the price breaches the triangle and the fractal support at 1.14344 mark, which is confirmed by the Donchian upper boundary. A buy pending order can be placed at this level. A stop loss may be placed at the channel opposite border. The further bearish momentum should be confirmed by the oscillator trend. The stop loss is supposed to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point.

| Position | Buy |

| Buy stop | above 1.14344 |

| Stop loss | below 1.12907 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.