- Analytics

- Technical Analysis

GBP/USD Technical Analysis - GBP/USD Trading: 2016-07-26

In anticipation of the publication of GDP data and the Bank of England meeting

The British pound has been recently trading in a narrow range after a 12% sharp decline as a result of the victory of supporters of the country's exit from the European Union in a referendum of June 23, 2016. The main reason for the collapse of the pound was the fear that the Bank of England will expand the program of economic stimulus. Its next meeting will take place on August 4, 2016. Will the British currency strengthen if the Bank of England retains the main parameters of monetary policy?

Last week, two representatives of the Bank of England announced that there is no need to hurry with the rate cut, as political uncertainty after Brexit may lead to slower economic growth.

In this regard, we deem that preliminary GDP data for the second quarter of the current year, which will be released on July 27, 2016, will have particular importance. According to forecasts, its growth will remain at the level of the first quarter and will be 2%. Note that the Bank of England current rate is 0,5%, which is much higher than similar indicators of the Fed, the ECB and the Bank of Japan. The decline of the pound was very rapid and it renewed a 30 - year minimum. Theoretically, the pound may be undervalued, as investors had little time for accurate macroeconomic estimates. In addition, the process of the UK exit from the EU may take much more time than it was expected immediately after the referendum.

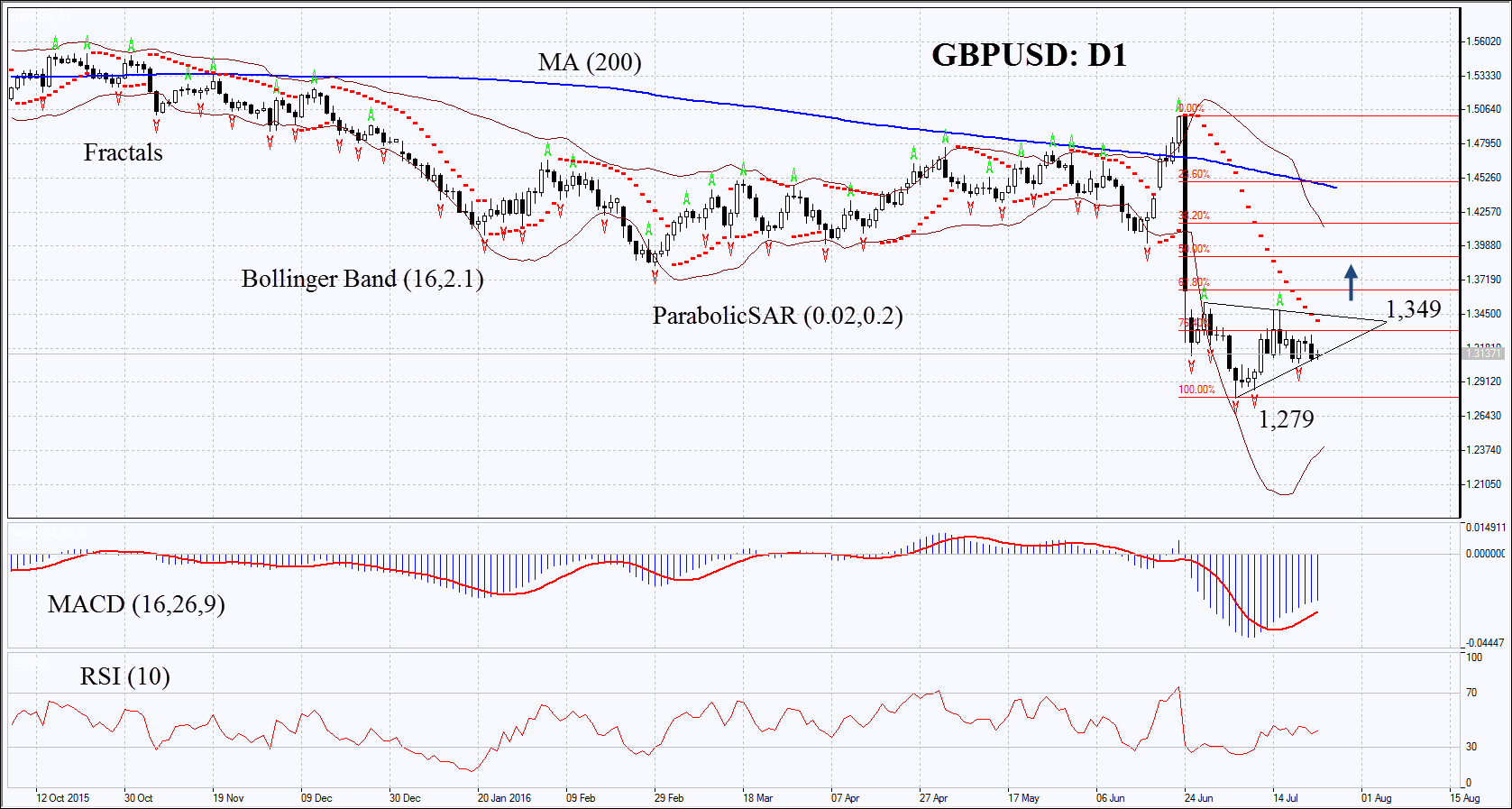

On the daily chart GBPUSD: D1 The price has stopped the downtrend on D1 and is moving sideways trying to breach upward from the triangle. The MACD indicator has formed the signal to buy. The Parabolic indicator still indicates sale, but its signal may serve as an additional level of resistance that must be overcome. The Bollinger bands have widen significantly which means high volatility. The RSI indicator is neutral and below 50. No divergence. The bullish momentum may develop in case the British pound exceeds the last fractal high, the upper boundary of the triangle and Parabolic signal at 1,349. This level may serve as a point of entry. The initial stop-loss may be placed below the recently renewed minimum since the mid-80s of the last century at 1, 279. After opening the pending order we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 1, 279 without reaching the order at 1,349, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Sale |

| Buy stop | above 1,349 |

| Stop loss | below 1,279 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.