- Analytics

- Technical Analysis

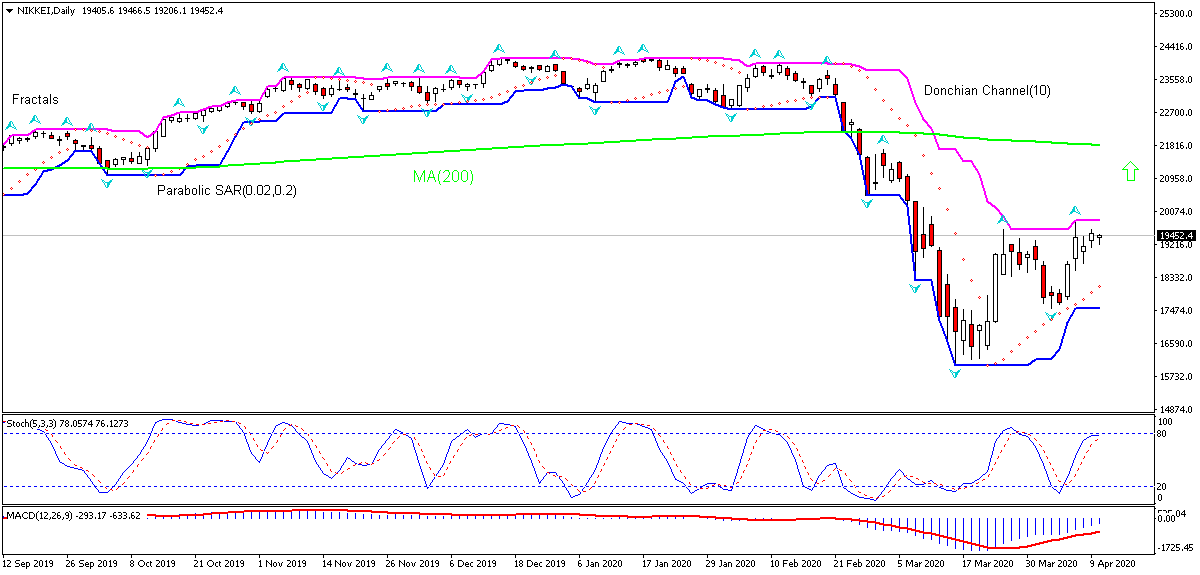

Japan 225 Technical Analysis - Japan 225 Trading: 2020-04-10

Nikkei Index Technical Analysis Summary

Above 19854.6

Buy Stop

Below 17529.9

Stop Loss

| Indicator | Signal |

| MACD | Buy |

| Stochastic | Neutral |

| Donchian Channel | Neutral |

| Fractals | Buy |

| Parabolic SAR | Buy |

| MA(200) | Sell |

Nikkei Index Chart Analysis

Nikkei Index Technical Analysis

On the daily timeframe the Nikkei: D1 is rising toward the 200-day moving average MA(200) after hitting 37-month low in mid-March. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 19854.6. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 17529.9. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (17529.9) without reaching the order (19854.6), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of Indices - Nikkei Index

Japan’s economic data have been mixed in recent weeks. Will the NIKKEI rebound continue?

Recent Japanese economic data were mixed. Current account surplus widened in February while machinery orders decline accelerated. The Tankan index for big manufacturers' sentiment fell to a seven-year low of -8 in the first quarter of 2020 from 0 in the prior period, though it still came above market expectations of -10. At the same time large firms indicated plans to rase capital expenditures by 1.8%, down from 6.8% in the previous quarter but above a 1.1% expected decline. And while machinery orders decline accelerated in March to 2.4% over year from 0.3% in February, the decline was smaller than feared. Meanwhile machine tool orders decline accelerated sharply next month to 40.8% over year from 29.6% in February. However, Japan’s government unveiled a monetary and fiscal stimulus package on April 7 to combat coronavirus impact. The total package is worth 108 trillion yen ($990 billion), equal to 20% of Japan’s gross domestic product, with direct fiscal spending amounting to 39.5 trillion yen, or about 7% of the GDP. These measures, together with monetary stimulus program by other developed economies including the US and European Union, buoyed investors’ confidence, leading to recovery in equity market.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.