- Analytics

- Technical Analysis

OATS Technical Analysis - OATS Trading: 2016-08-22

Oats fell behind in growth

In this report we would like to present you another trading instrument — oats. Russia, Canada and Australia are its major producers. Oats prices have been falling behind other grains recently. Will their prices continue advancing?

Oat is used to produce all-mash for livestock. Its price may depend not only other grain futures but also on beef and pork. Due to the relatively small volume of global oat market, there is no much data and news on this culture. We may emphasize that now oat is 17% cheaper than it was in early 2016 while corn is just 5% cheaper and wheat is 6% cheaper. The lean hog is being traded at around level of early January 2016.

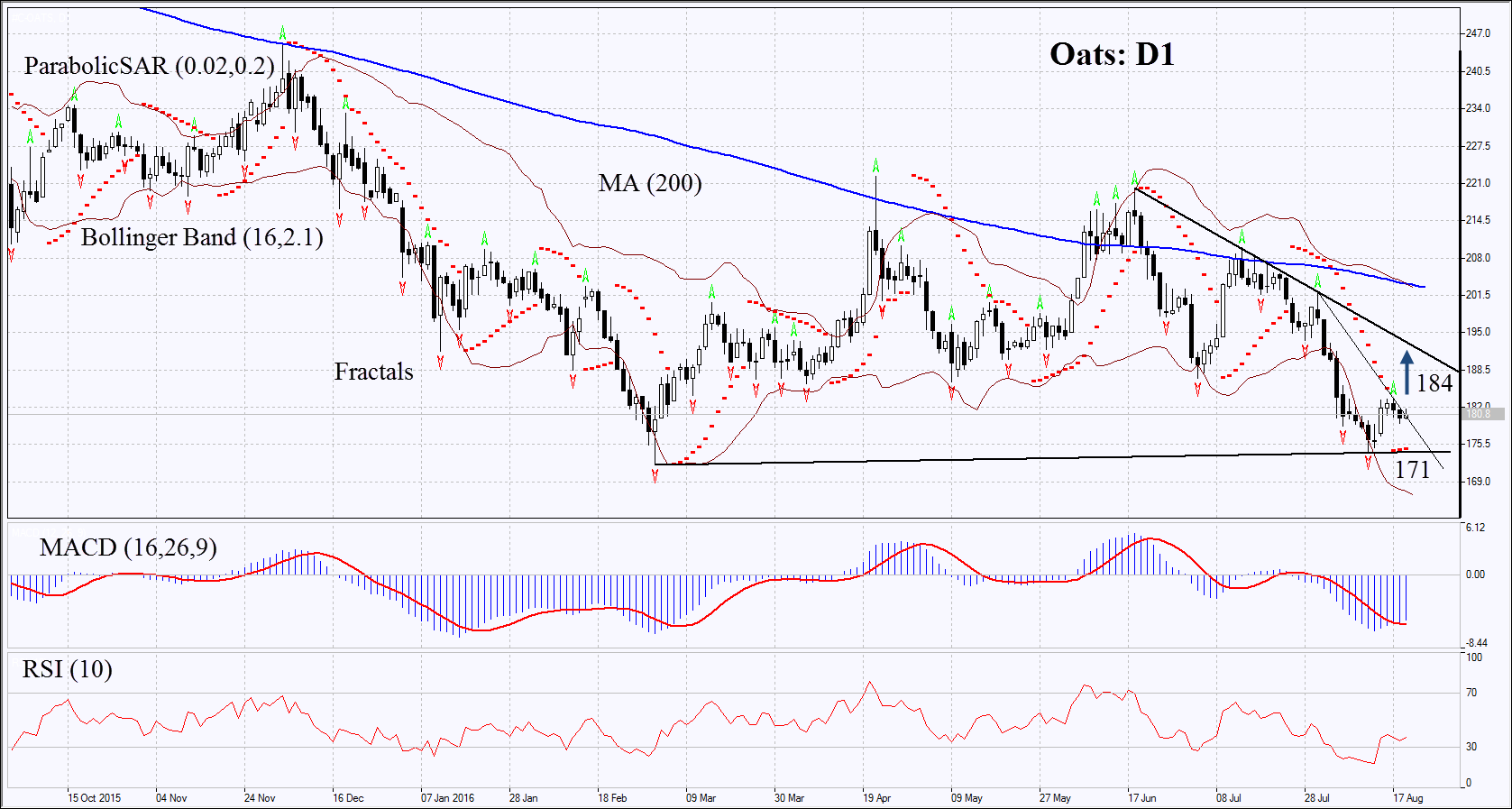

On the daily chart Oats: D1 failed to fall below its 7-year low hit in early March and started correcting upwards. The MACD and Parabolic indicators give signals to buy. The Bollinger bands have widened a lot which means higher volatility. RSI has left the overbought zone and is below 50, no divergence. The bullish momentum may develop in case the oats surpass the last fractal high at 184. This level may serve the point of entry. The initial stop-loss may be placed below the Parabolic signal, the 7-year low and the last fractal low at 171. Having opened the pending order we shall move the stop to the next fractal low following the Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop-loss level at 171 without reaching the order at 184, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

| Position | Buy |

| Buy stop | above 184 |

| Stop loss | below 171 |

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.