- Analytics

- Technical Analysis

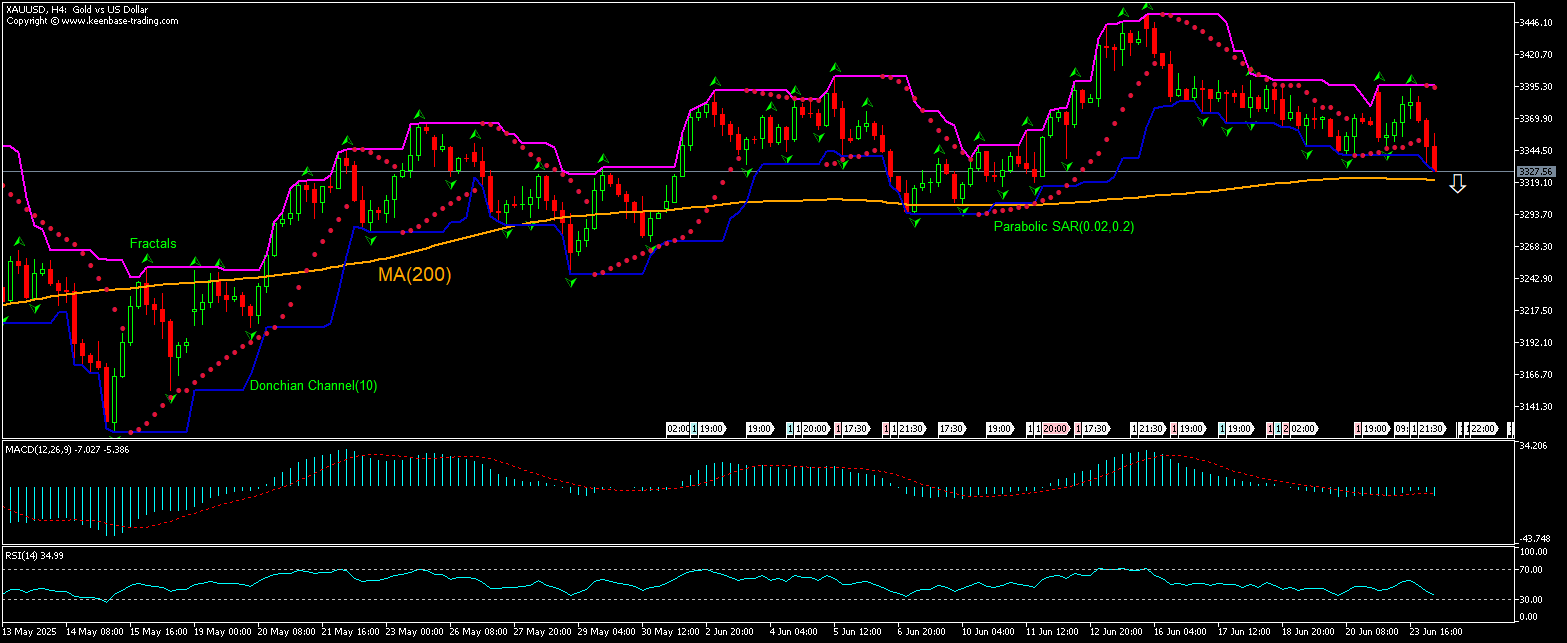

Gold vs. USD Technical Analysis - Gold vs. USD Trading: 2025-06-24

Gold Technical Analysis Summary

Below 3325.23

Sell Stop

Above 3391.78

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Sell |

| MA(200) | Buy |

| Fractals | Neutral |

| Parabolic SAR | Sell |

Gold Chart Analysis

Gold Technical Analysis

The technical analysis of XAUUSD price on the 1-hour timeframe shows XAUUSD,H1 is testing the 200-period moving average MA(200) as it is retracing down after hitting 2-week high eight days ago. We believe the bearish momentum will continue after the price breaches below the lower Donchian boundary at 3325.23. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 3391.78. After placing the pending order the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3391.78) without reaching the order (3325.23) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Fundamental Analysis of Precious Metals - Gold

Gold prices are retreating after Iran’s missile attack on a US airbase in Qatar. Will the XAUUSD retreating continue?

Iran responded with a missile attack on a US airbase in Qatar after the US conducted aerial attack on Iran’s nuclear facilities. Usually in periods of heightened geopolitical uncertainty demand for safe haven precious metal rises as investors increase their holdings of gold for the ability of the safe haven asset to preserve its value. Currently though prices have been struggling to hold above $3,400 an ounce as it trades in a sideways pattern. However, major investment banks remain bullish on the safe haven precious metal. UBS particularly remains bullish on gold, maintaining its upside target of $3,800 an ounce. Banks’ bullish sentiment for gold is an upside risk for XAUUSD price.

Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.