- Analytics

- Market Overview

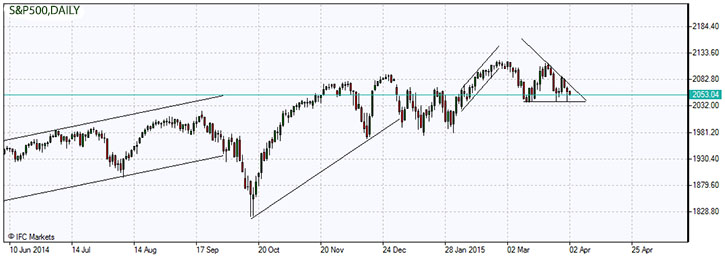

Stock markets mixed on diverging economic reports - 2.4.2015

US stocks extended losses on Wednesday as weaker than expected economic reports undermined market sentiment. ADP report showed private-sector employment increased in March by 189 thousand, less than the 225 thousand gain the prior month. According to the ISM survey manufacturing sector grew at the slowest pace in almost two years. Weaker than expected data add to recent indications that US economic growth has slowed in the first quarter, which increases the likelihood that the Fed may not hike the rates until late 2015. The dollar slipped against its major rivals, the ICE dollar index fell nearly 0.2%. Tomorrow nonfarm payrolls will be released, which are expected to show an increase of 248,000 jobs in March, following 12 monthly readings of above 200 thousand gains. Today at 13:30 CET Initial Jobless Claims and Continuing Claims will be released in US. At the same time February Trade Balance will be released. The tentative outlook is positive. And at 15:00 CET February Factory Orders will be released. The tentative outlook is positive.

European stock markets upped on Wednesday, partly recovering sharp losses the prior day after investors booked gains ahead of the new quarter. The gains were prompted by upward revisions of preliminary readings of manufacturing purchasing managers’ indexes for the euro-zone, including Spain and Italy. The reading for the euro-zone was revised up to 52.2, compared with a flash estimate of 51.9. The Stoxx 600 added 0.3%, with Germany’s DAX 30 index rising 0.3%, while France’s CAC 40 index advanced 0.6%. Euro advanced against the dollar. The Athex Composite Index closed 1.3% lower on concerns Greece could miss its €450 million loan repayment to the International Monetary Fund next week as the Greek government and its international lenders still struggle to reach a reform agreement. European Central Bank President Mario Draghi said the Governing Council wants to see inflation hardening around the 2% level. The launch of ECB’s €60-a-month quantitative-easing program in March has weakened euro, and sustained improvement in economic outlook together with lower input costs (particularly energy costs) and higher overseas earnings due to the weaker euro may result in significantly higher euro-zone GDP growth in 2015 compared with 0.9% in 2014. No important economic data are expected today in euro-zone.

Nikkei advanced 1.5 percent today as hedge funds covered their short positions and the Bank of Japan bought 35.2 billion yen worth of exchange traded funds on Wednesday, when the market fell to a three-week low.

Oil prices rose on Wednesday on the backdrop of rising crude-oil supplies, stronger-than-expected gasoline demand and a delay in Iran’s nuclear talks. The US Energy Information Administration data indicated crude-oil inventories rose 4.8 million barrels to 471.4 million, the highest level in about eight decades. At the same time the 4.3 million barrel drop in gasoline inventories was higher than the expected decline of 1.25 million barrels, easing concerns about potential oil storage shortage that may result in putting more supply on the spot market. The data also showed a 36,000 barrel-a-day drop in production to 9.386 million barrels, which could be a first step to eventual inventory declines. Oil prices have fallen for three consecutive quarters.

Gold prices rebounded on Wednesday to reclaim the $1,200 mark as a weaker dollar and disappointing economic data boosted the demand for the safe haven asset.

See Also