- कंपनी

- वेबसाइट विजेट्स

गेट फ्री फोरेक्स विजेटस

आपको लगता है कि आपकी वेबसाइट का अभाव है कुछ है और आप सही सामग्री जोड़ने के लिए नहीं जानते? आईएफसी बाजार की जरूरत है तुम बिल्कुल सब कुछ प्रदान करेंगे मुक्त करने के लिए: अपने वेबसाइट, ब्लॉग या फोरम के लिए वित्तीय अपनी वेबसाइट और अधिक सूचनात्मक बनाने और अधिक अपने ग्राहकों को संतुष्ट.

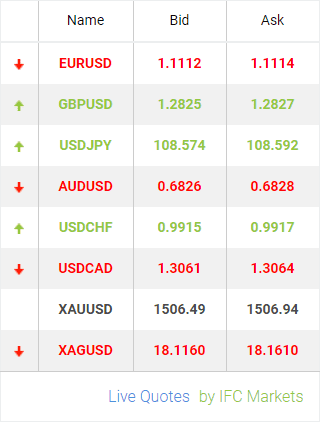

नि: शुल्क लाइव उद्धरण टिकर IFC बाजार द्वारा अपनी वेबसाइट में जोड़ें, ब्लॉग या फेसबुक पेज और आपके आगंतुकों को ट्रैक करने के लिए एक महत्वपूर्ण अवसर दे लेटेस्ट एक्सचेंज रेट्स जो वास्तविक समय में नवीनीकृत कर रहे हैं.

लाइव मुद्रा

कोड प्राप्त करें

आप अपनी वेबसाइट पर लाइव चार्ट विजेट उत्पन्न कर सकते हैं, अपने दर्शकों के लिए लाइव कोटेशन देखने की अनुमति होगी जो करेंसी पेयर्स, स्टॉक्स, फुटुरेस एंड इंडीकेस अलग समय फ्रेम में: 5 मिनट से 1 सप्ताह के लिए.

कोड प्राप्त करेंइस विजेट को डाउनलोड करने के साथ जो विदेशी मुद्रा और CFD बाजारों पर अद्यतन जानकारी प्रदान करेगा ,जो आपको और अधिक सटीक भविष्यवाणी करने के लिए मदद और बेहतर व्यापारिक निर्णय करने में मदद करेगा .

डाउनलोड

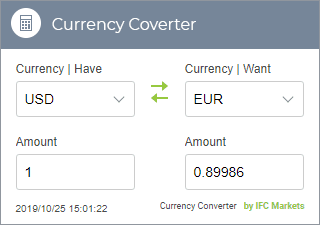

मुद्रा परिवर्तक विजेट अप के वेबसाइट या ब्लॉग के लिए एक सुविधाजनक पूरक है. विनिमय दर का यह कैलकुलेटर आपके आगंतुकों सभी प्रमुख मुद्राओं की दरों की गणना करने की अनुमति होगी जो एक साधारण मुद्रा विजेट है,लाइव मुद्रा दरों का उपयोग.

रूपांतरण में जगह लेता है रियल टाइम.

कोड प्राप्त करें

IFC बाजार, यह आपकी वेबसाइट, ब्लॉग या फेसबुक पेज पर रखकर से नि: शुल्क लाइव विनिमय दरों विजेट जाओ और अप करने की तारीख पर रहने के लिए अपने आगंतुकों की अनुमति दें लाइव एक्सचेंज रेट्स के वित्तीय बाजार दिन के 24 घंटे.

कोड प्राप्त करें

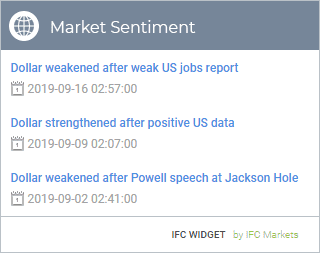

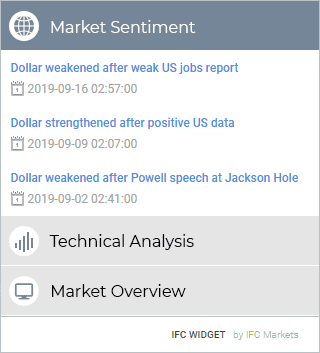

बाजार भावना विजेट है व्यापारी खुले पदों के संतुलन में सभी महत्वपूर्ण परिवर्तनों को दर्शाता है, रूप में अच्छी तरह के रूप में शामिल है सभी आवश्यक चार्ट् स और टिप्पणियाँ. बाजार के भावों की रिपोर्ट कमोडिटी वायदा व्यापार आयोग (CFTC) के आंकड़ों पर आधारित हैं.

कोड प्राप्त करें

बाजार सिंहावलोकन विजेट वित्तीय दुनिया पर सभी नवीनतम डेटा शामिल हैं. दैनिक बाजार सारांश प्राप्त करने के लिए आप की अनुमति दें, हमारे पेशेवर विश्लेषकों द्वारा किए गए.

कोड प्राप्त करें

अपनी वेबसाइट पर हमारे तकनीकी विश्लेषण विजेट जगह, ब्लॉग या फेसबुक पेज, इस प्रकार का अवसर देने के हमारे पेशेवर विश्लेषकों द्वारा किए गए वास्तविक समय तकनीकी विश्लेषण सारांश देखने के लिए व्यापारियों के लिए.

कोड प्राप्त करें

सूचित रहने से आगे बाजार जा करने के लिए सबसे अच्छा तरीका है. अब तुम समय के आँकड़ों की समीक्षा करने की विशाल राशि खर्च करने की जरूरत नहीं, शोध कर रहे हैं या विदेशी मुद्रा बाजार आंदोलनों अनुमान करने की कोशिश कर रहा.

कोड प्राप्त करें Explore our

Trading Conditions

- Spreads from 0.0 pip

- 30,000+ Trading Instruments

- Stop Out Level - Only 10%

Ready to Trade?

Open Account